MARKET INSIGHT

A deep dive look into the sectors

Select a Sector

Industry Medical Devices & Supplies

Medical Devices & Supplies

MARKET INSIGHT

Segment Rational

RATIONAL

The Medical Devices industry is expected to benefit from the ambitious healthcare transformation program and the government’s commitment to support local capabilities through local content policies. The industry represents a highly attractive domestic opportunity, as there is a high potential to cater to the Kingdom serving the increasing domestic demand and largest medical devices market in the region. In addition, proximity to and free trade agreements with countries in the region with much higher Medical Devices spend per capita than the global average and promising market growth forecasts create ideal conditions for investment in this industry. The Medical Devices manufacturing skill set, and value chain capabilities have similarities with other sectors, promising cross-pollination of industrial know-how and value chain capabilities. Finally, the industry has become more strategically important amid the COVID-19 pandemic to ensure self-sufficiency for essential medical products and secure national resilience of healthcare supply chains.

Segment Trends and Value Proposition

SEGMENT TRENDS

National Healthcare transformation program.

Customer centricity and low-cost solutions.

Industry consolidation and focus on CMO1.

MedTech innovations and IoMT2.

Heightened need for supply chain resilience.

Value Proposition

• MEA market is expected to grow at a higher pace than global market driven by economic prosperity, growing medical awareness, aging populations, and wider healthcare coverage and subsequent expenditures.

• The Medical Devices industry is expected to benefit from the ambitious healthcare transformation program and the government’s commitment to support local capabilities through local content policies.

• KSA’s Medical Devices industry remains the biggest market in the region and is expected to grow at more than 5% from 2020 to 2023.

Segment Value Chain

Global Medical Devices Market

• In 2020, Covid-19 outbreak drove a greater spending on health personnel, infrastructure, administration, medical equipment and consumables; which is expected to continue in decreasing amounts until the pandemic is over.

• As healthcare budgets and resources are redirected to the fight against Covid-19, spending on high margin products has decreased.

• Different regions in the world will have similar growth rates in medical devices spending in the next years.

Regional Medical Devices Market

• MEA is forecasted to be among the highest growth regions for Medical Devices, driven by wider healthcare coverage and subsequent expenditures.

• KSA is forecasted to remain the largest regional market for Medical Devices, despite the large market drop impact in 2015-16 due to oil market crises.

• Developments in global commodity prices in the next years and outlook of Covid-19 pandemic can impact Medical Devices spend significantly.

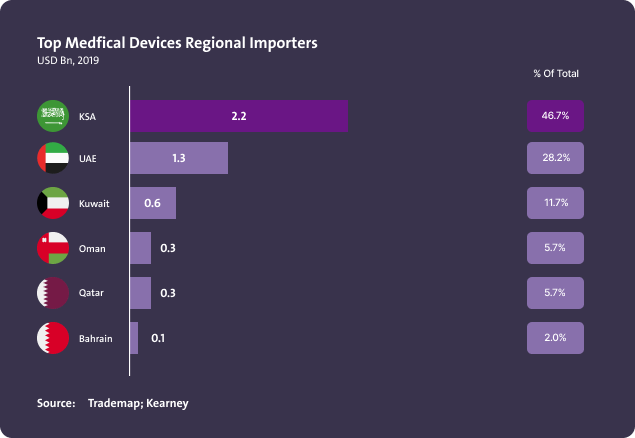

Top Medical Devices Regional Importers

Key insights:

• KSA is the biggest importer in GCC, with almost half of the imports.

• UAE imports constitute more than one-fourth of regional imports although UAE’s population is less than one-fifth of total regional population.

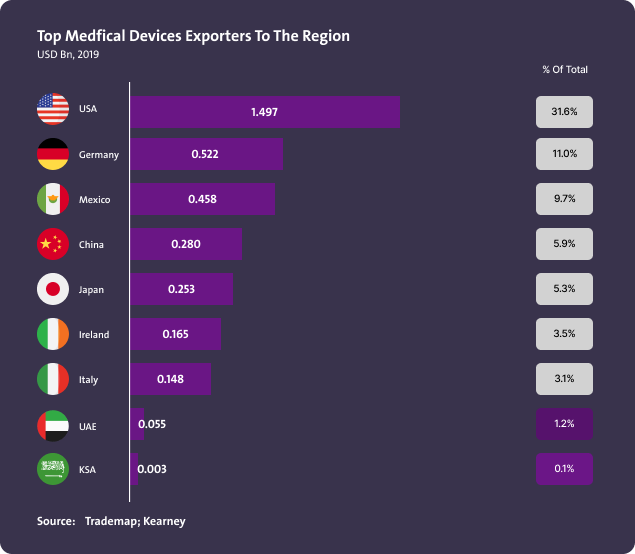

Top Medical Devices Exporters to the Region

Key insight:

• Despite being the biggest importer, exports of KSA to the region are minimal; which highlights significant room for improvement.

• USA covers around one-third of the exports, with remaining share covered by countries around the world.

KSA Medical Device Market

• 5.2% healthcare expenditure as share of GDP

• 4.8% medical devices market size as share of healthcare expenditure

• Covid-19 had a strong positive impact on specific areas (e.g. consumables, ventilators), while most other devices were negatively affected due to pressure placed on healthcare resources priorities’.

• Government is considered main market driver with over ~66% market share, however, an ambitious healthcare transformation plan promises higher private-sector participation.

Local Market Share by Product Type

KSA Manufacturing Scene

KSA manufacturing scene is expected to be supplying ~6% of total market demand, with predominant focus on Consumables.

Localization attractiveness Vs. localization feasibility

• ~80% of the opportunities prove to be highly attractiveness and localizable.

• Majority of High feasibility opportunities are localized to some degree and need support for expansion.

• Medium feasibility opportunities is the largest segment and will need concerted efforts of tech transfer by JV or acquisition.

• Low feasibility opportunities are majorly strategic in nature with intricate assembly steps, thus needing long term effort to additionally establish an OEM ecosystem to localize manufacturing.

Total Market Size of Medical Supplies in Saudi Arabia

Energy for non-surgical and medical saliva maker in Saudi Arabia (tons)

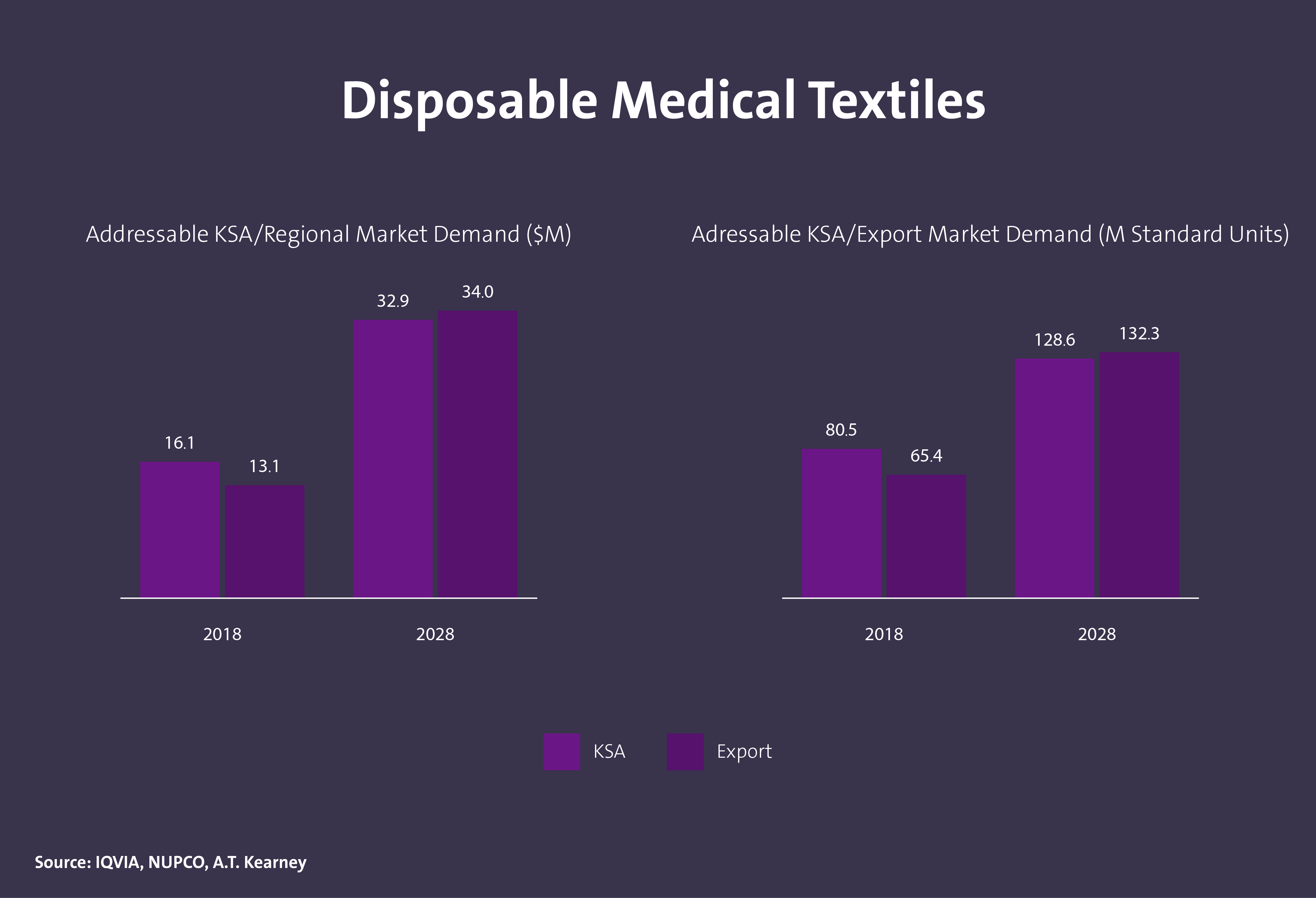

Imports of surgical coats and disposable coats to Saudi Arabia

Imports of surgical aprons and gowns to Saudi Arabia

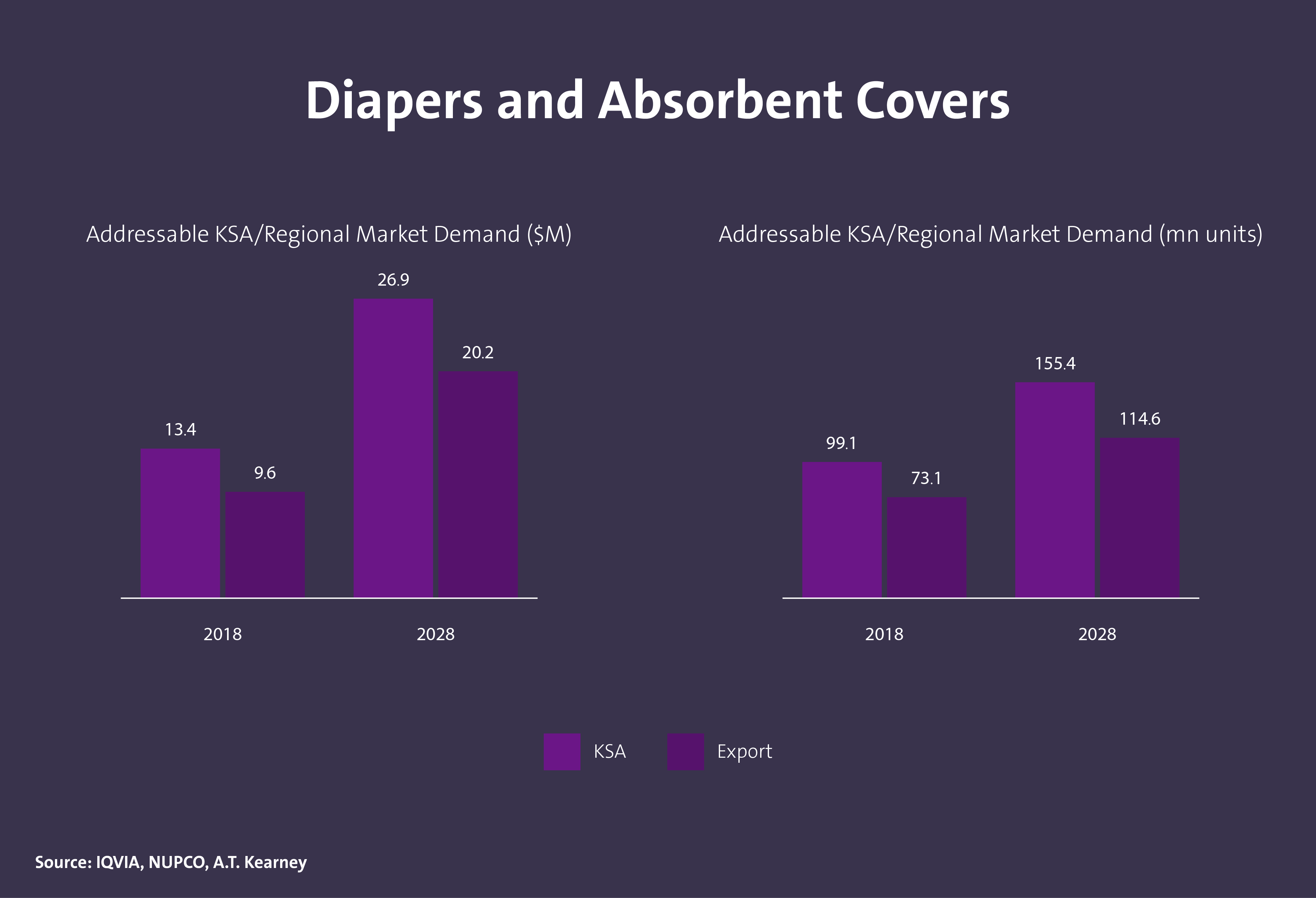

Imports of Underpads for Patients To Saudi Arabia

Imports of Underpads for Patients To Saudi Arabia

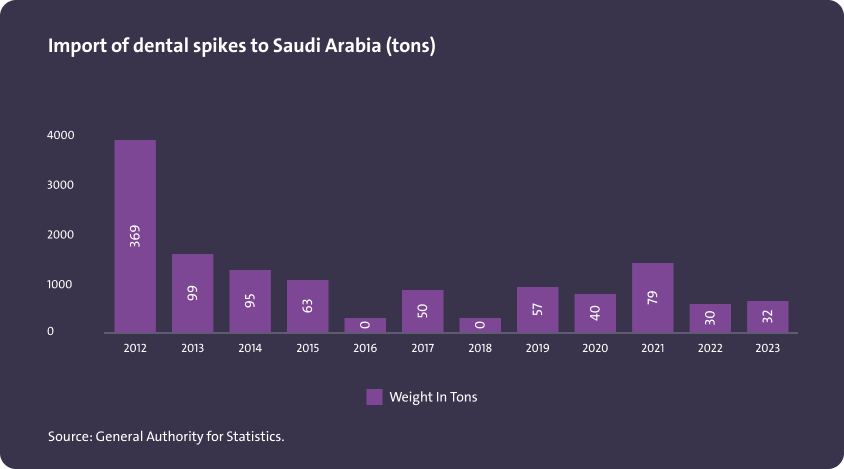

Import of dental spikes to Saudi Arabia (tons)

There are 26 dental colleges in Saudi Arabia in which students spends an average of 7 years including one year internship till they start their career as dentists. These schools graduate more than 2,200 dentists per year. The total number of students per year is an average of 6,000 to 7,000 students. These students consume large amounts of dental burs during their education in the clinical and internship phases.

Graphene import to Saudi Arabia by country (tons)

Saudi Arabia's Market Size of Dental Burs

Forecast of future demand for dental burs in Saudi Arabia (tons)

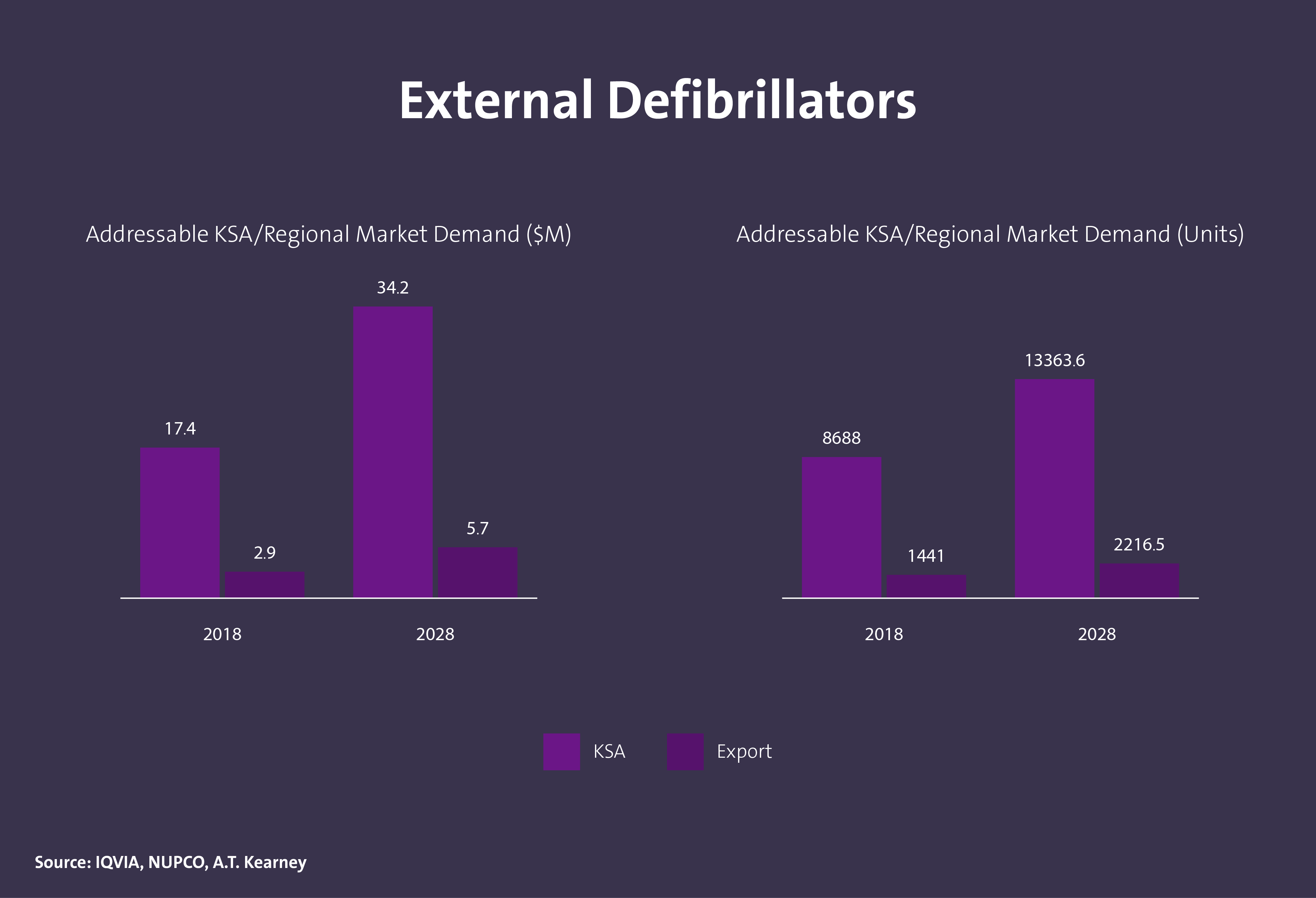

KSA EXTERNAL DEFIBRILLATORS MARKET DEMAND

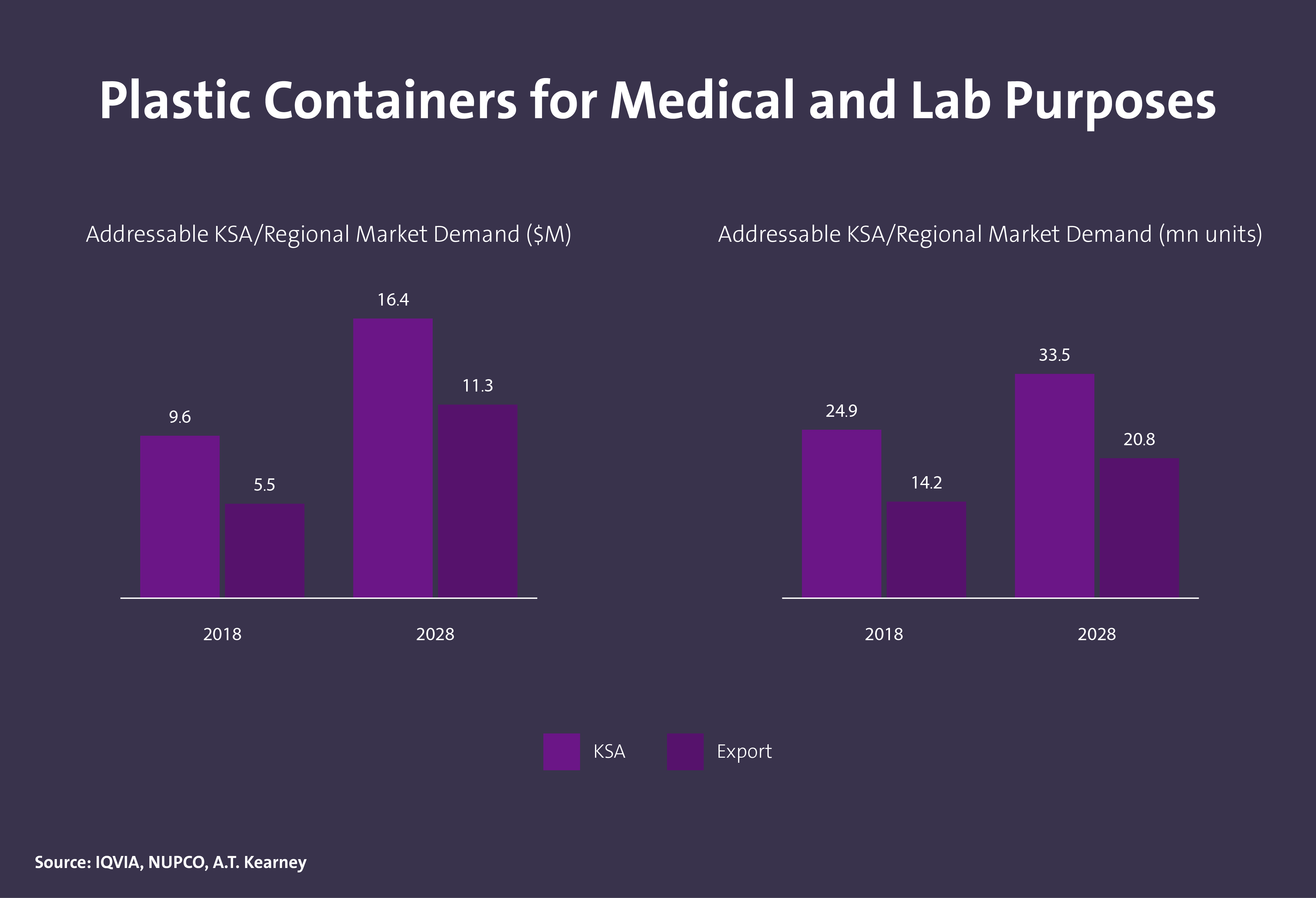

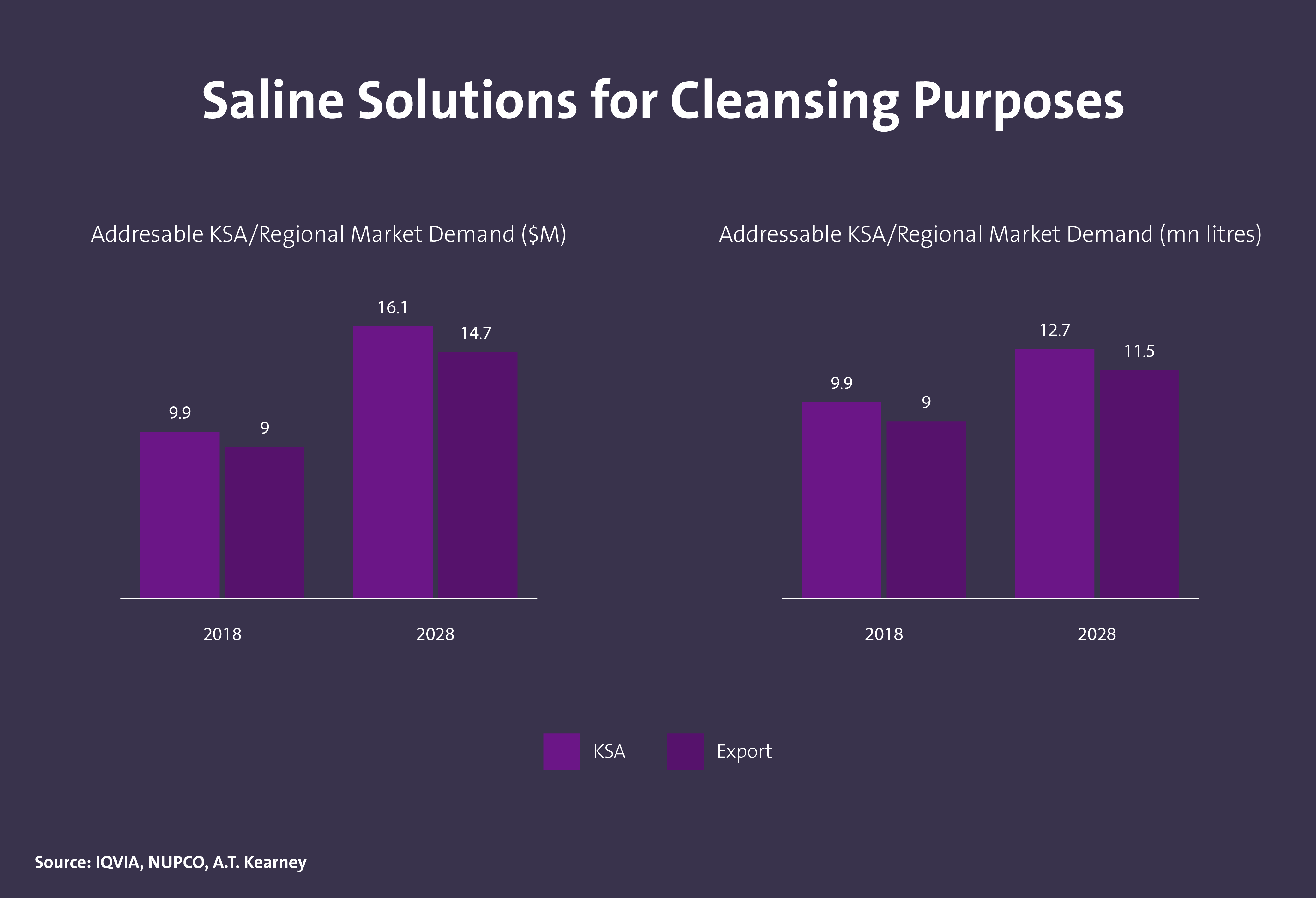

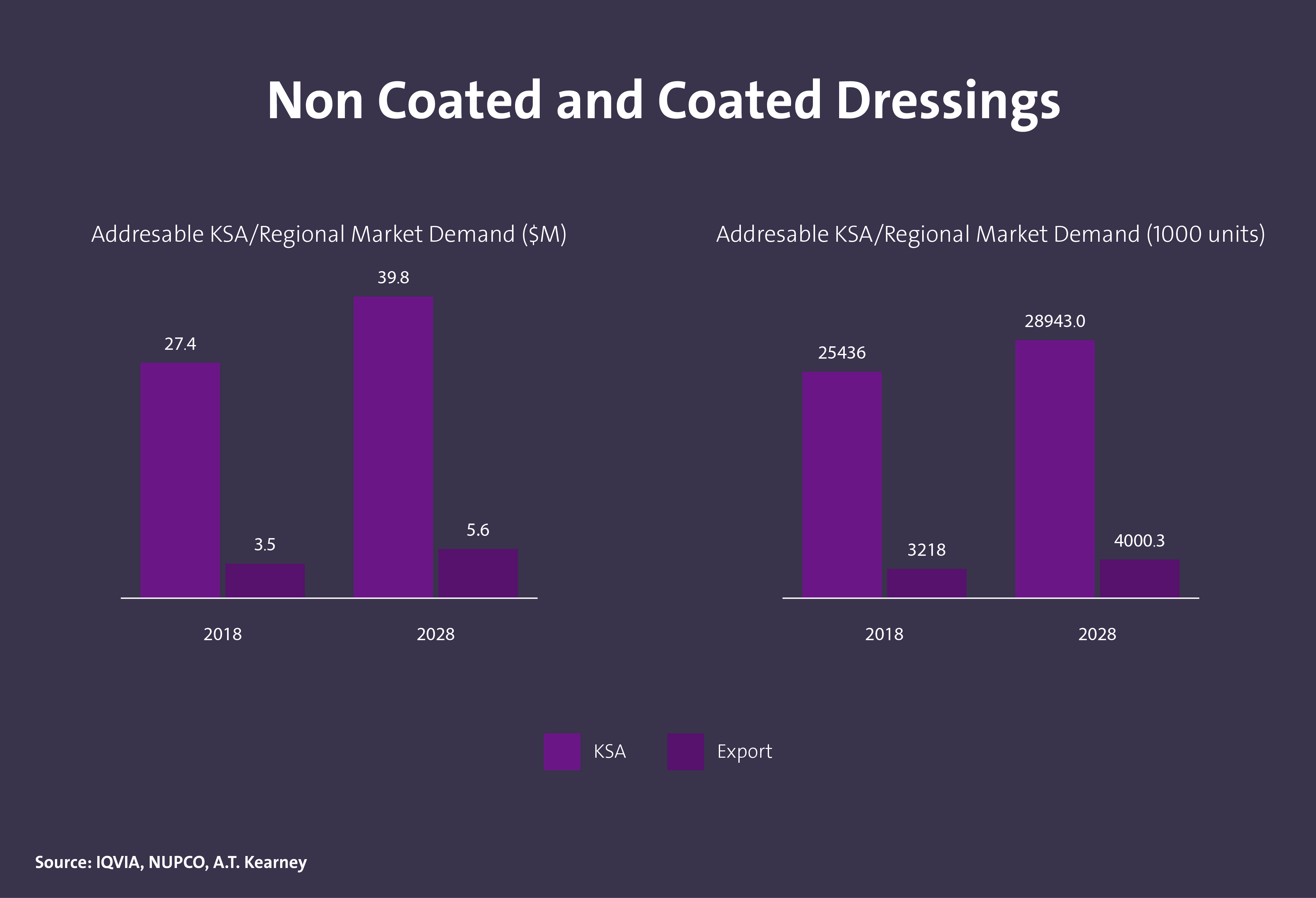

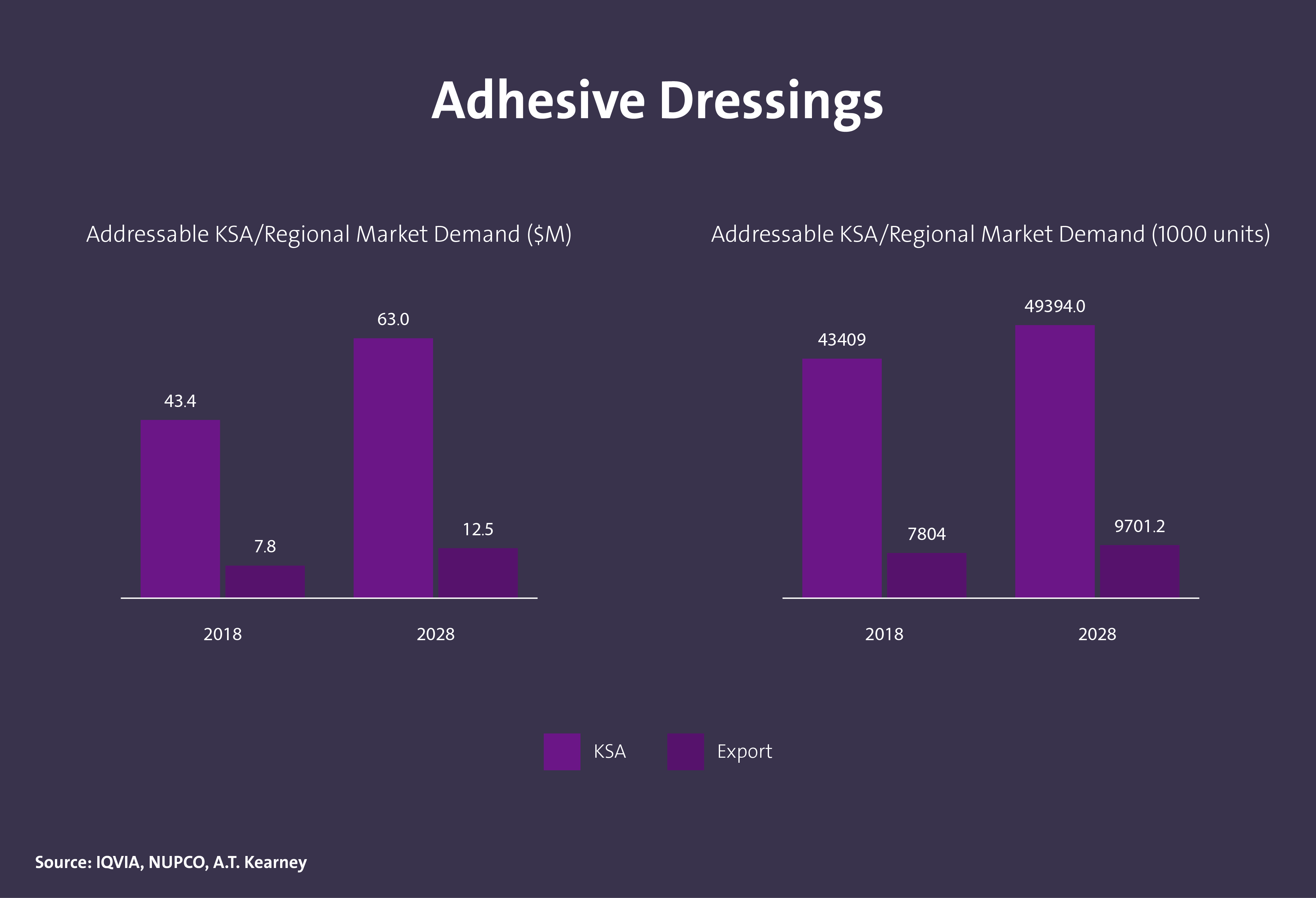

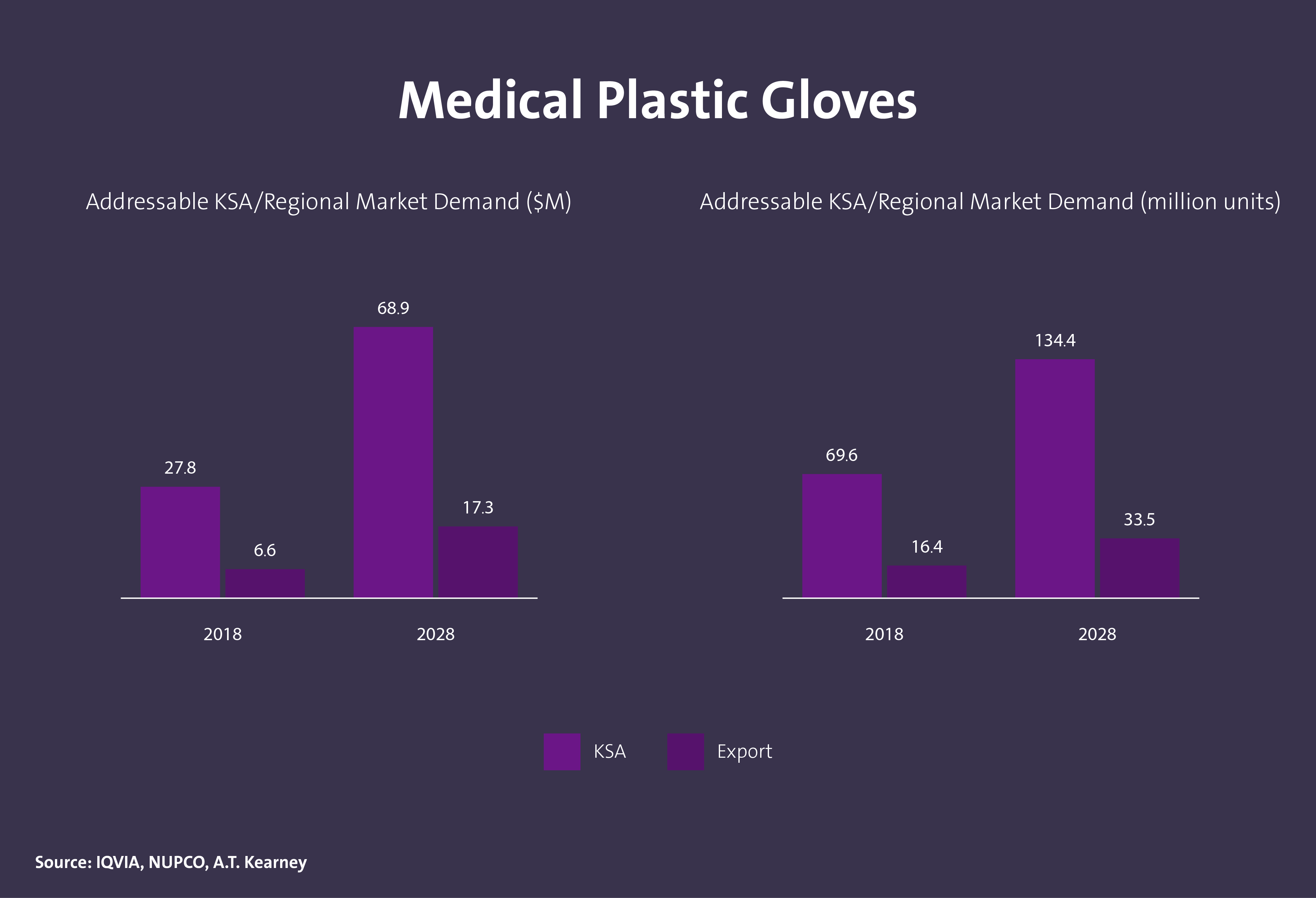

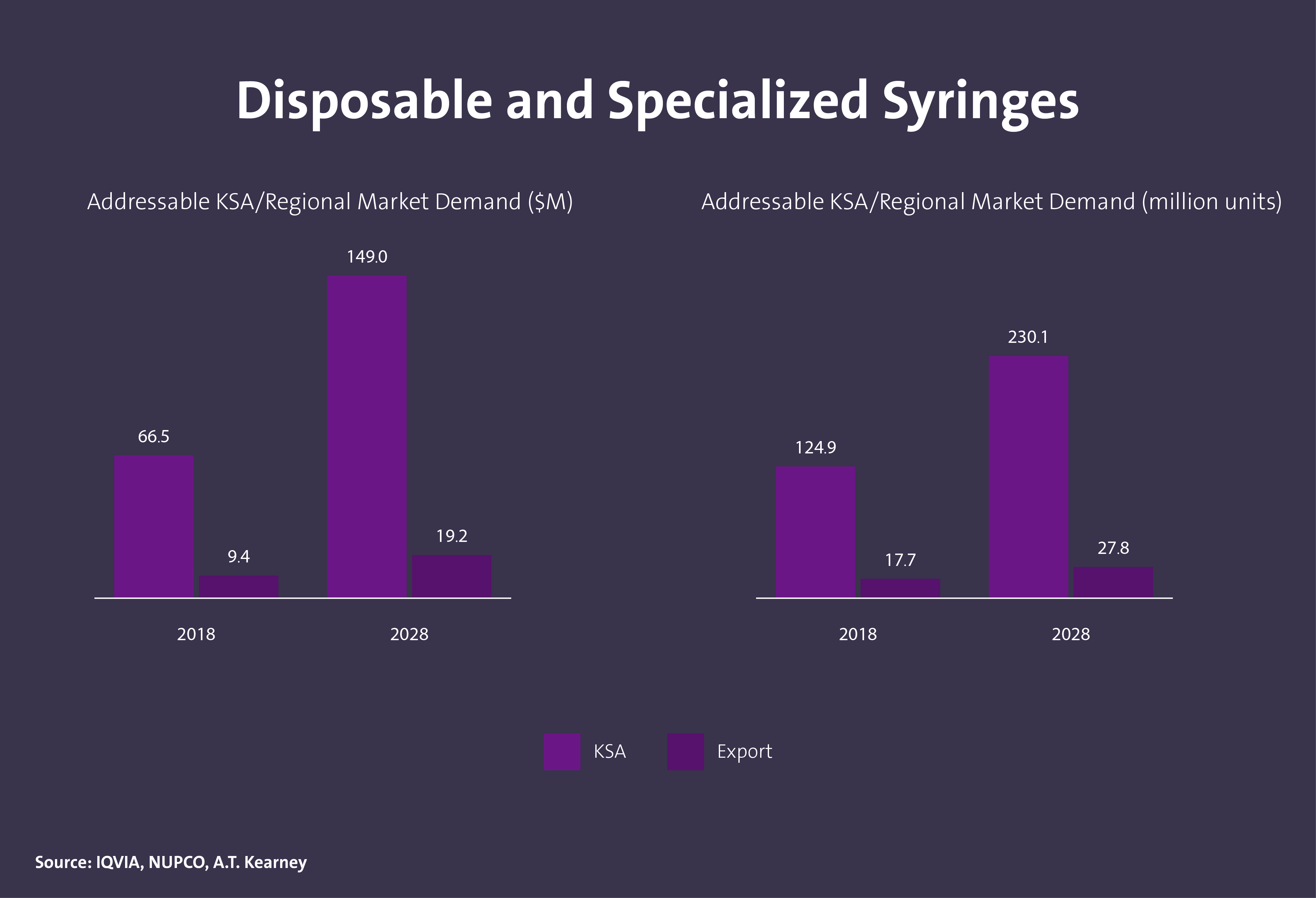

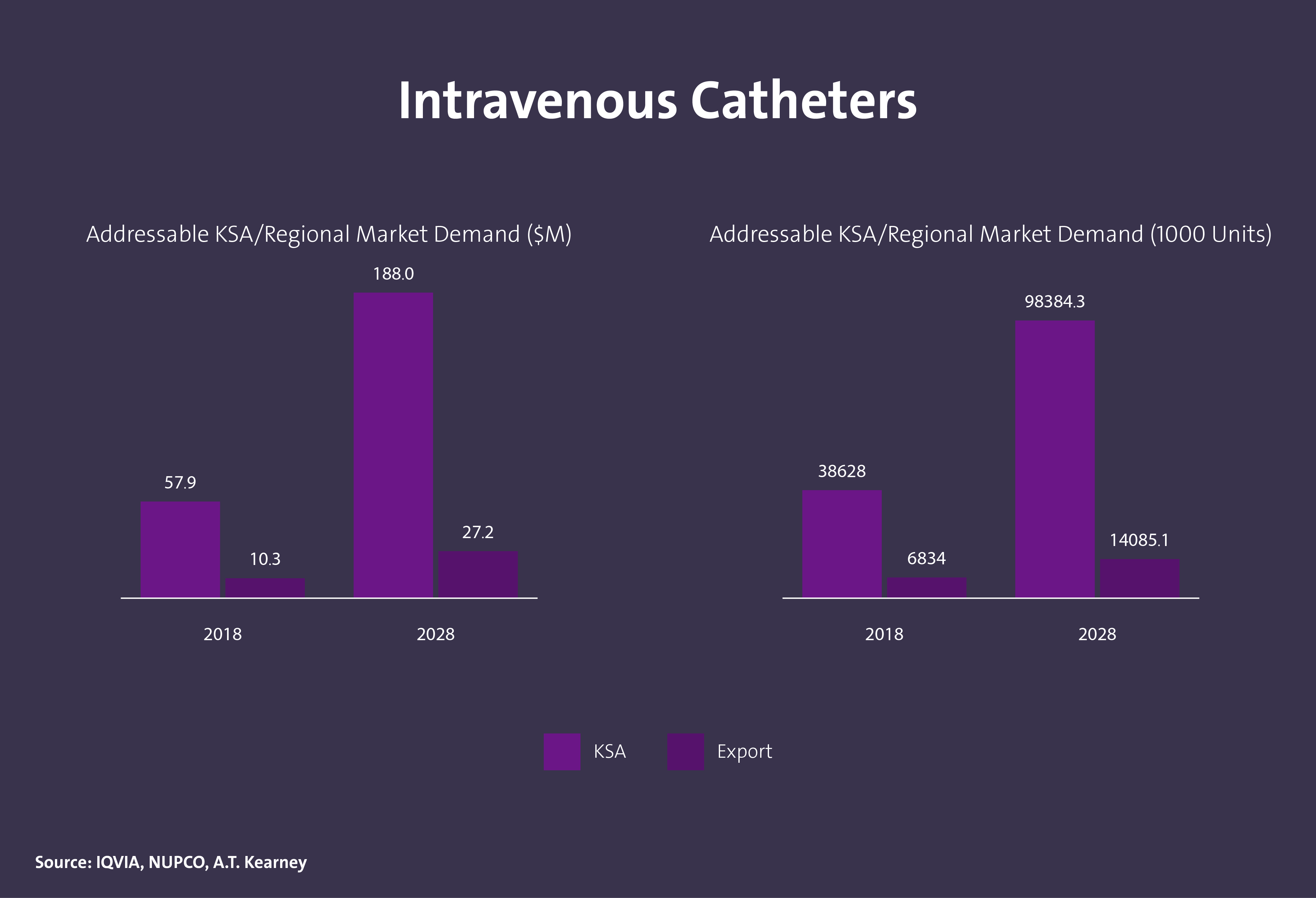

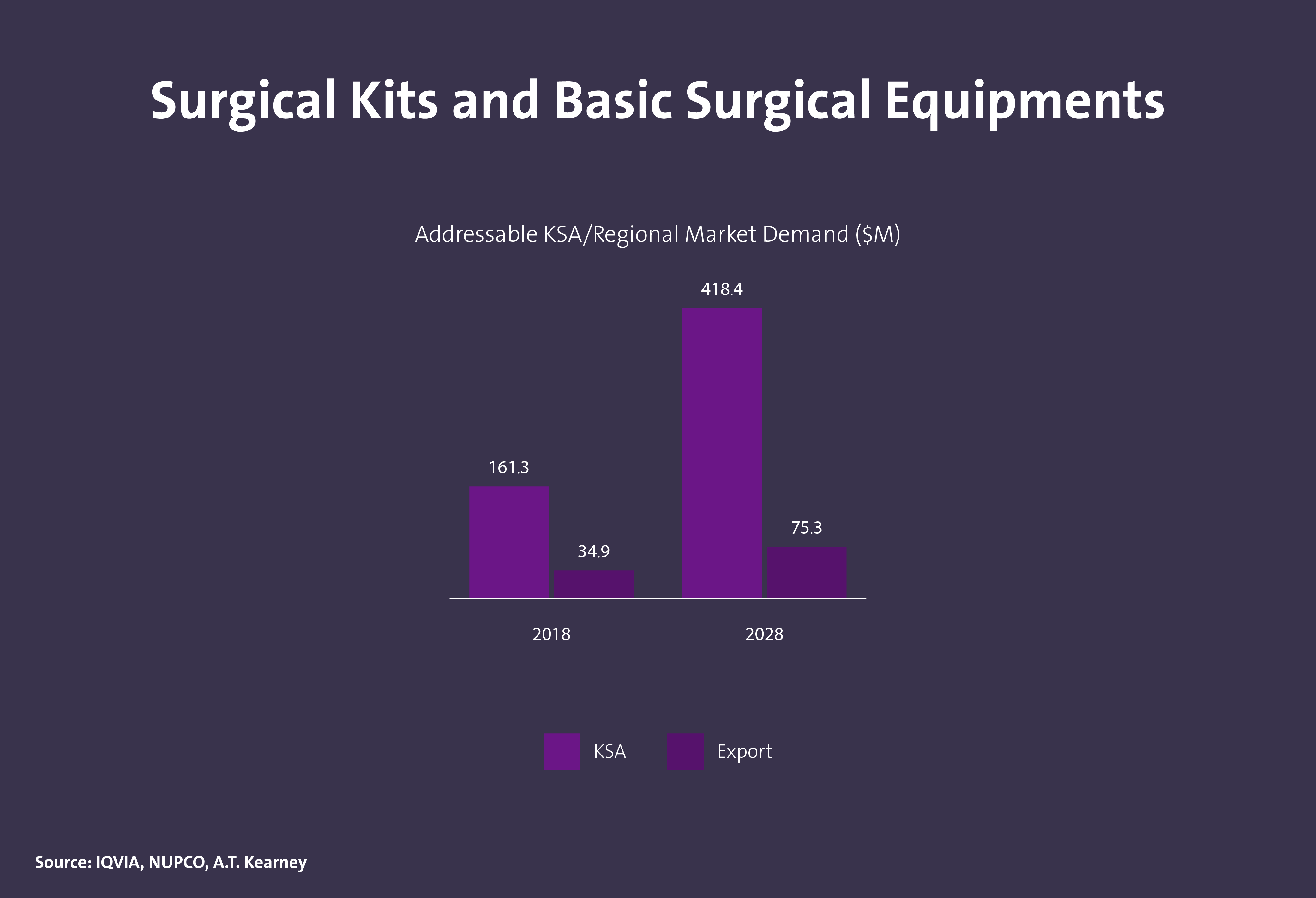

KSA CONSUMABLES MARKET DEMAND

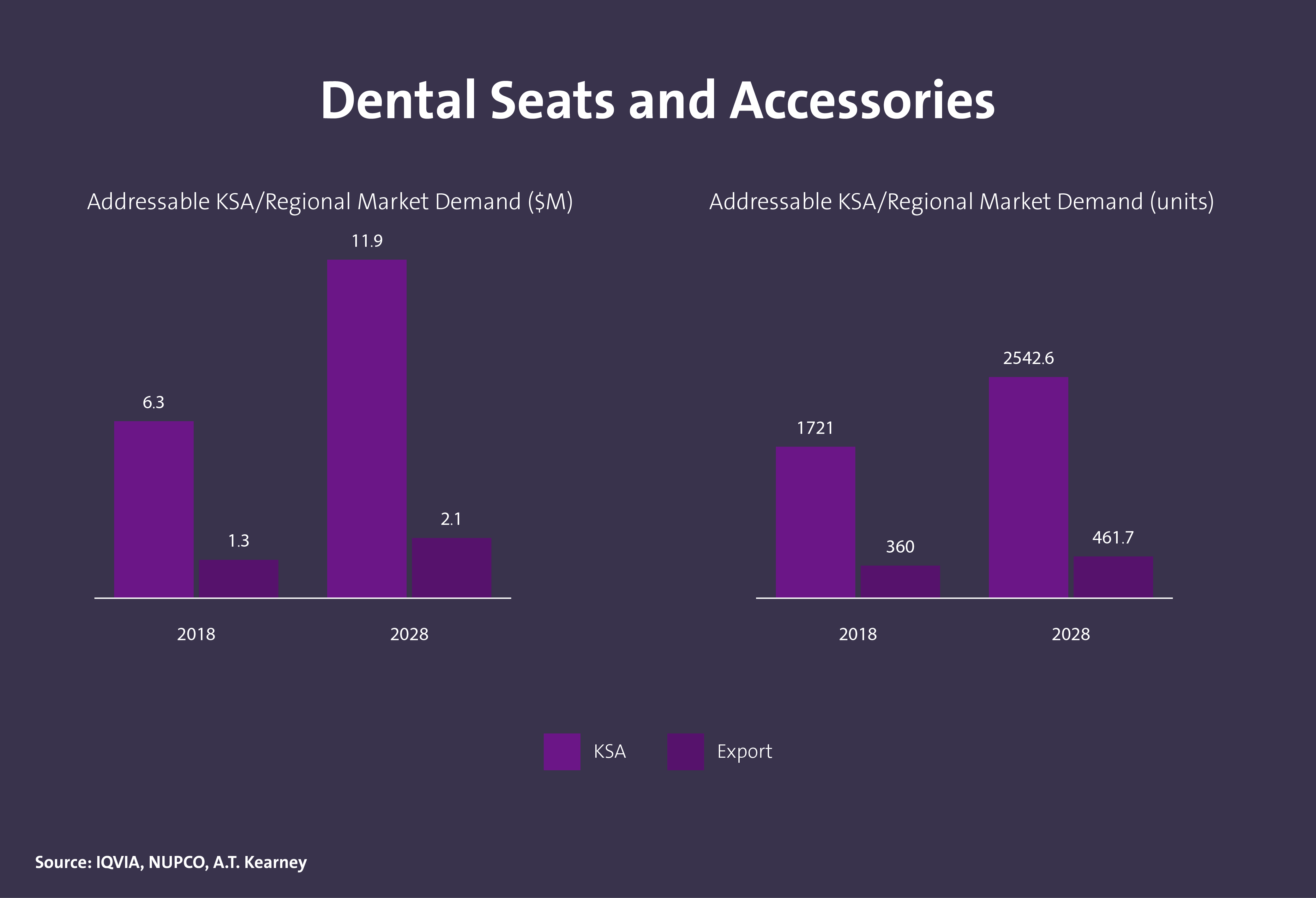

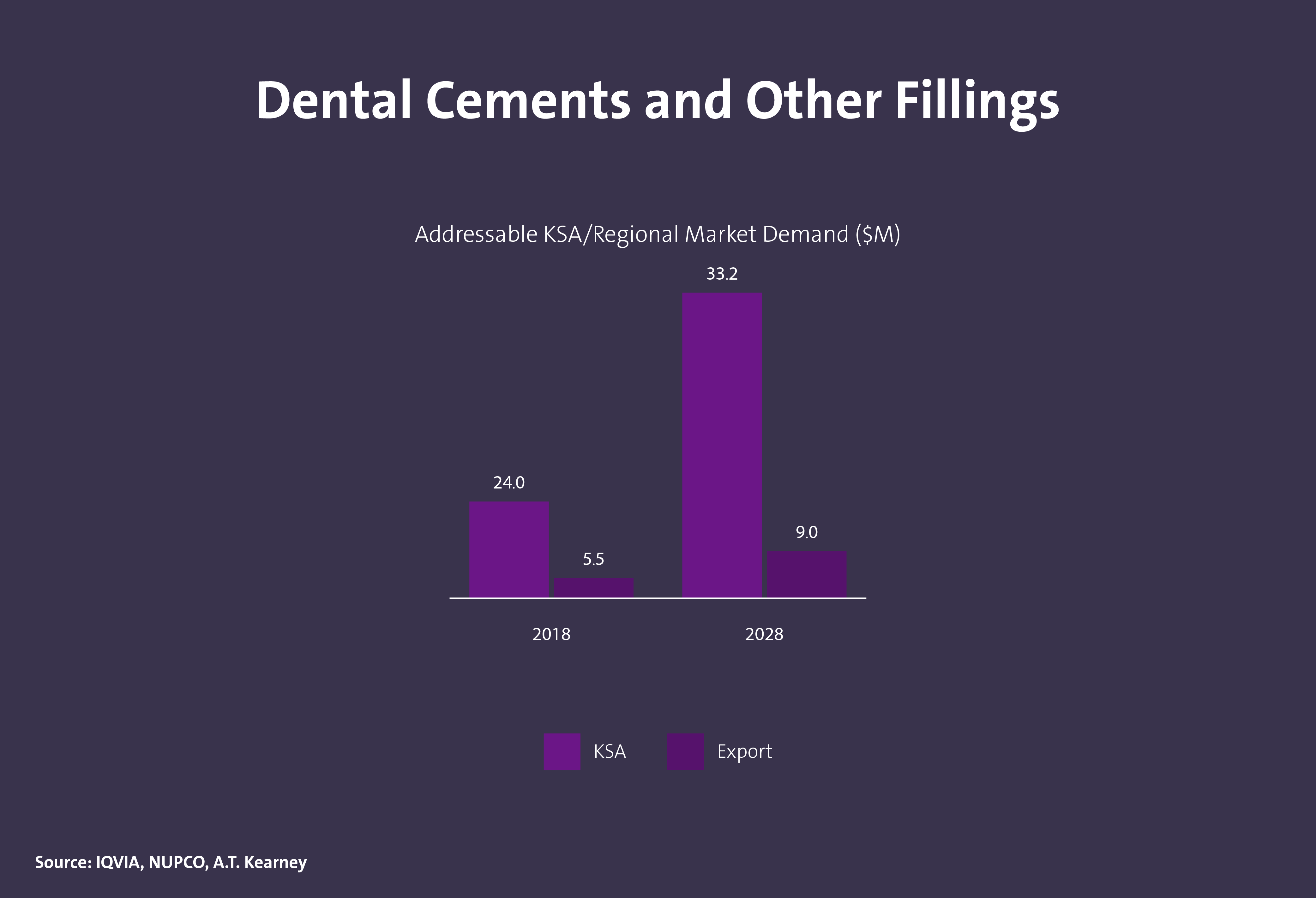

KSA DENTAL PRODUCTS MARKET DEMAND

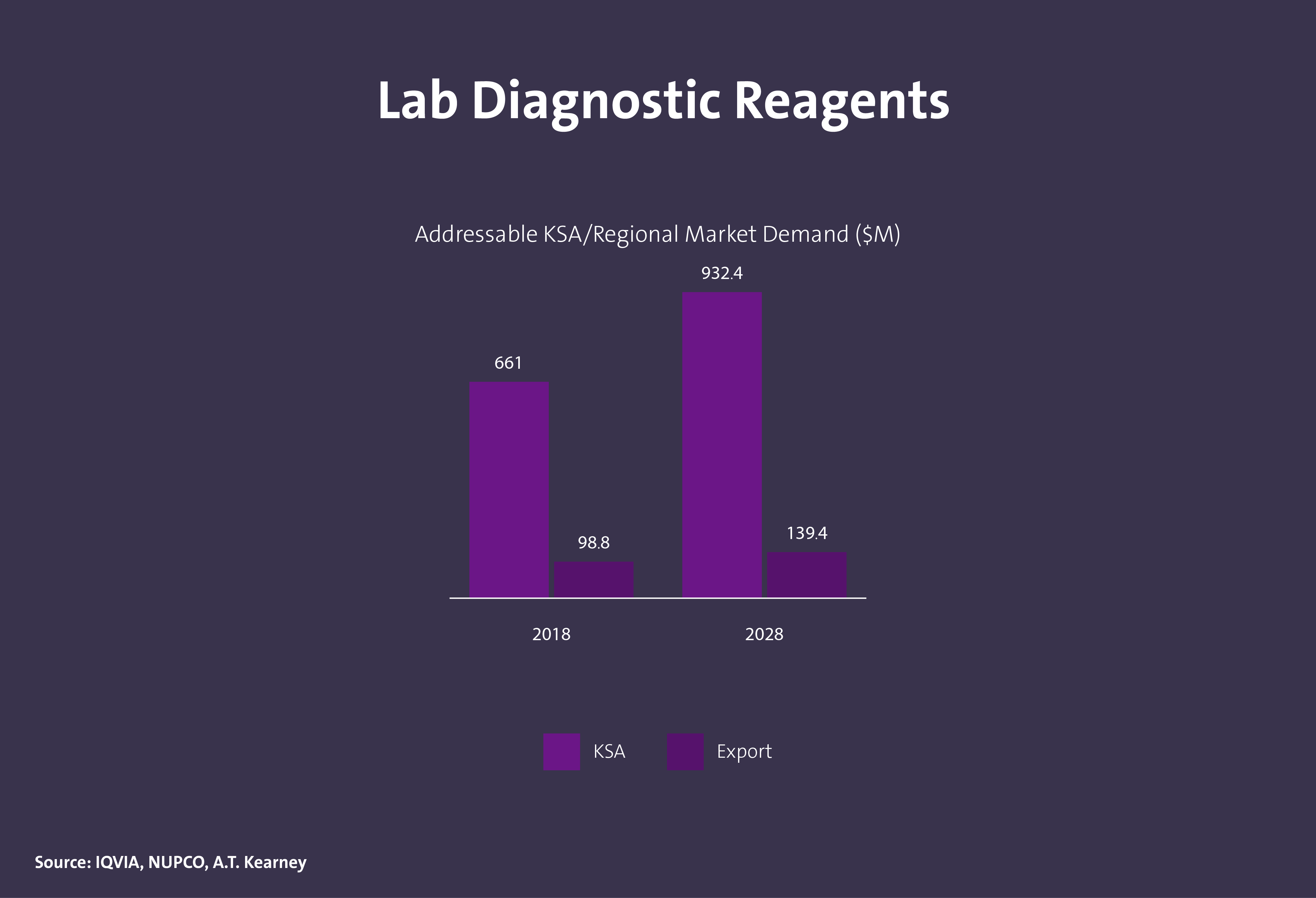

KSA LAB MATERIAL MARKET DEMAND

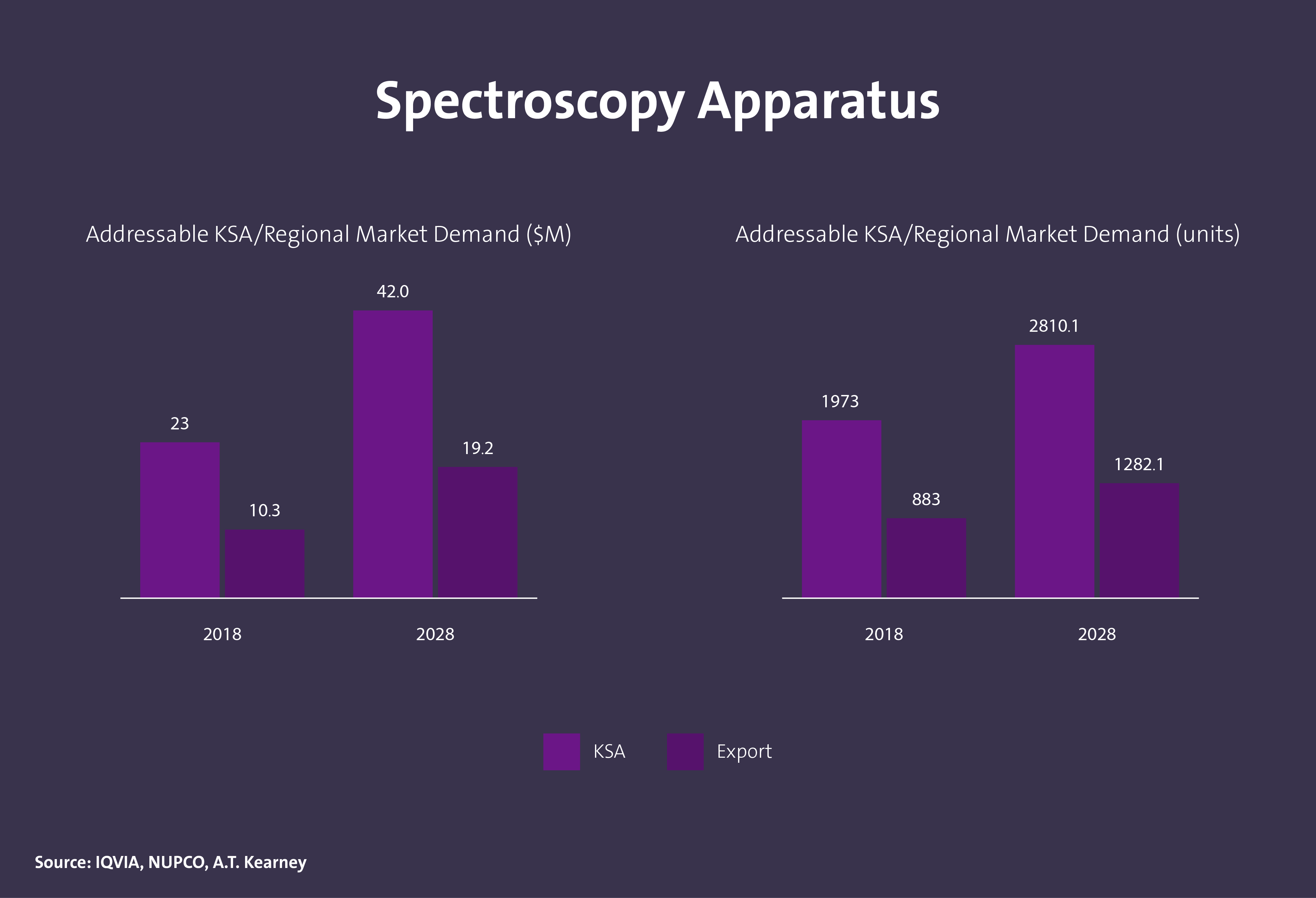

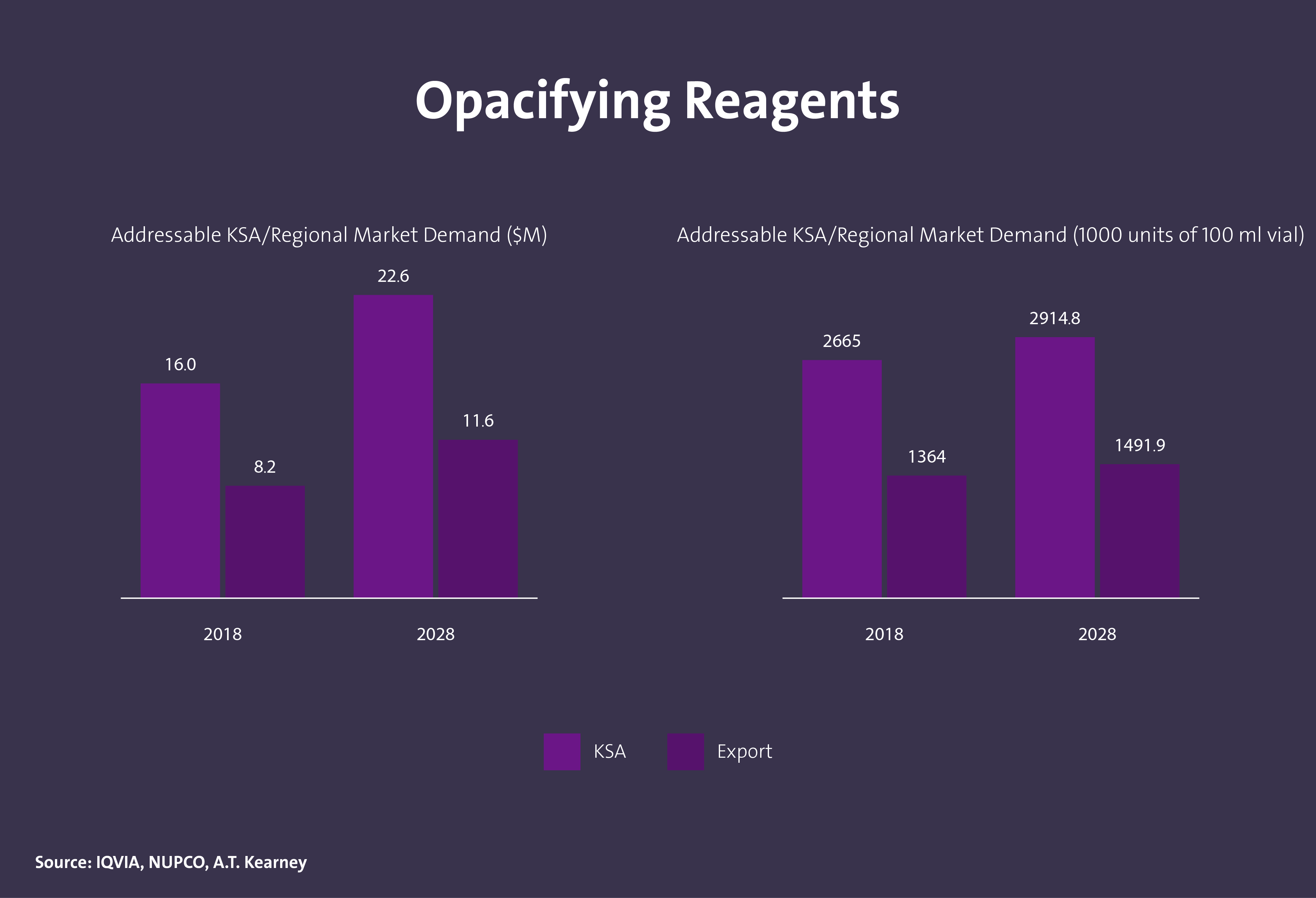

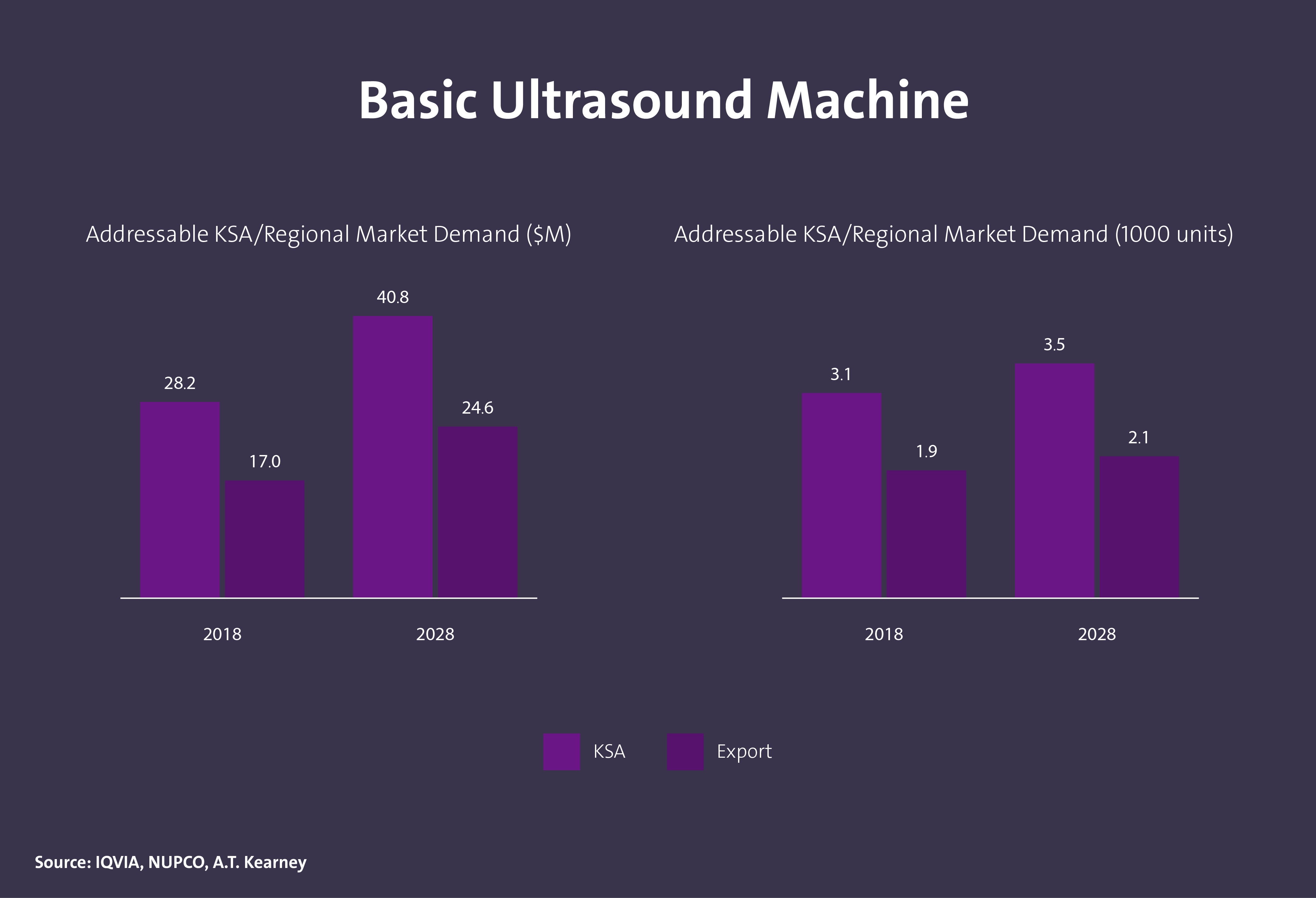

KSA DIAGNOSTIC IMAGING MARKET DEMAND

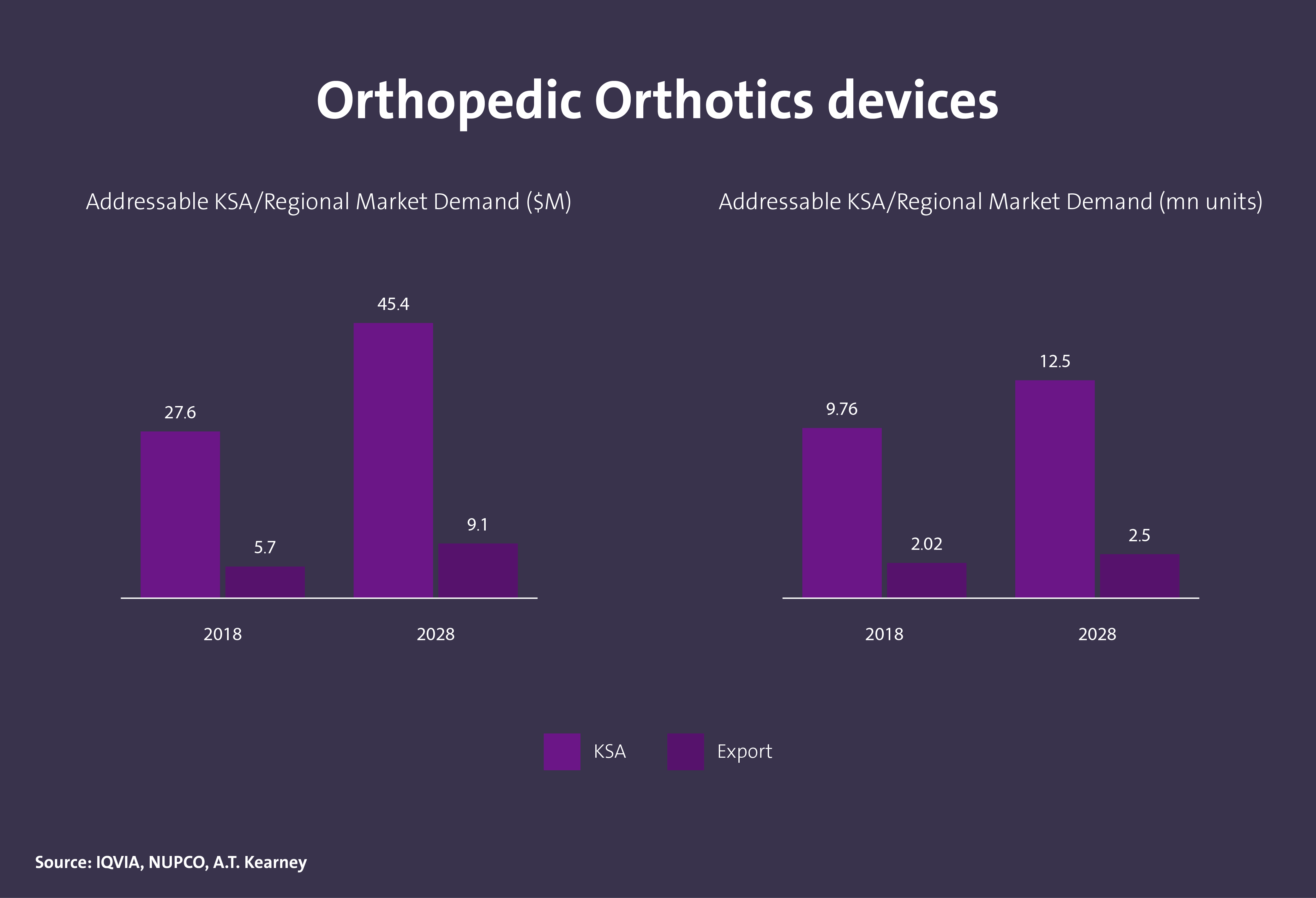

KSA ORTHOPEDICS MARKET DEMAND

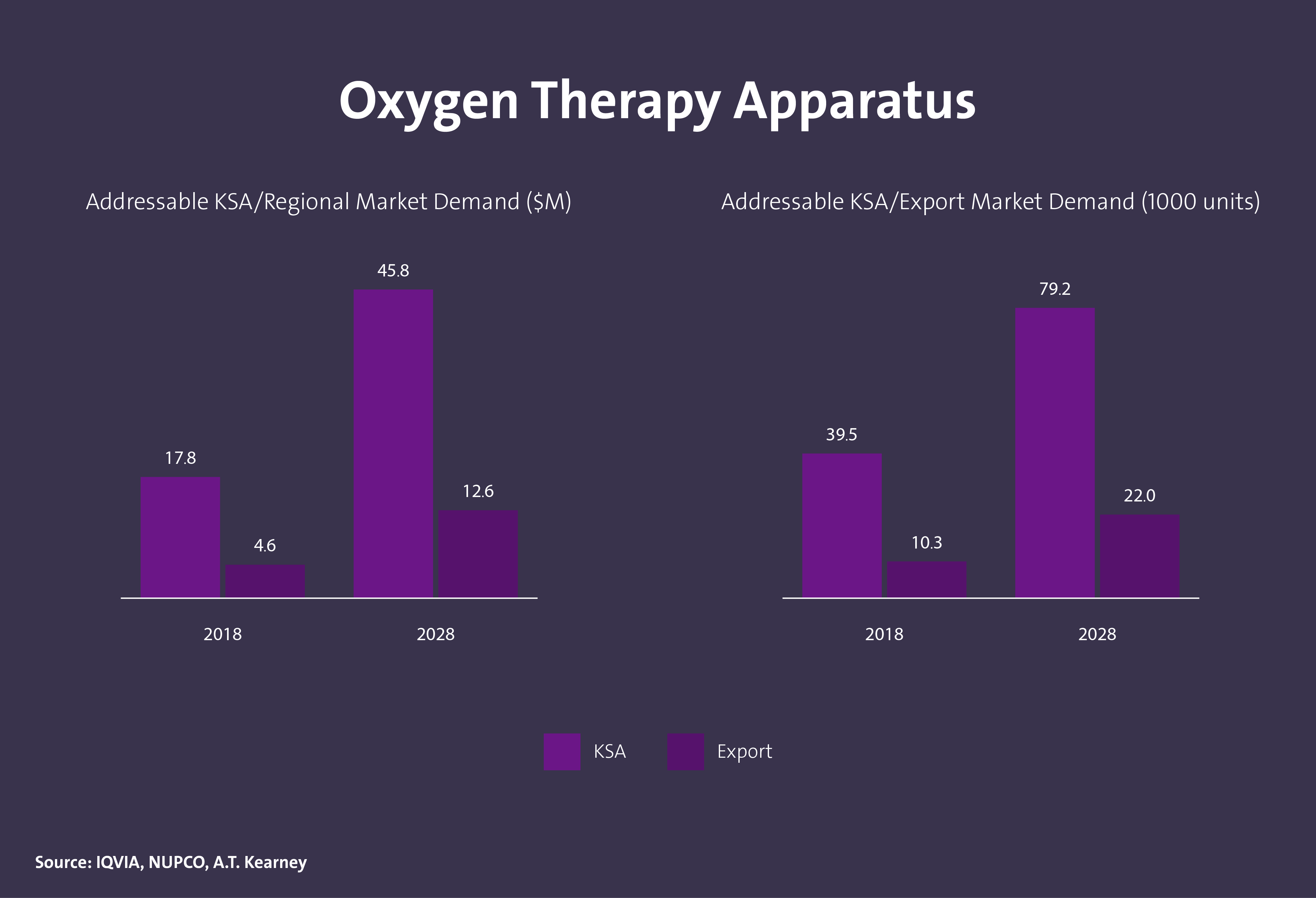

KSA OXYGEN THERAPY APPARATUS MARKET DEMAND

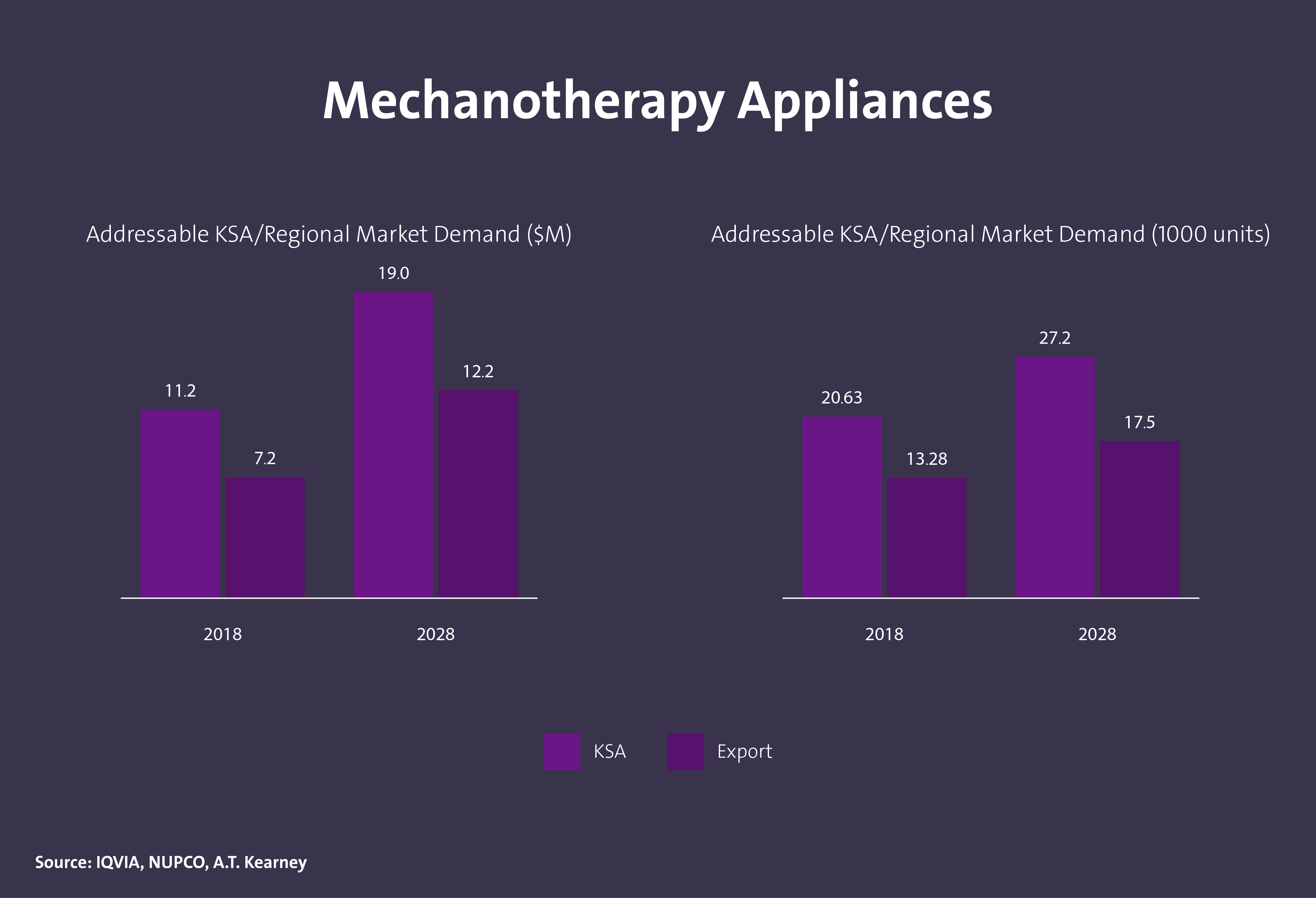

KSA MECHANOTHERAPY APPLIANCES MARKET DEMAND

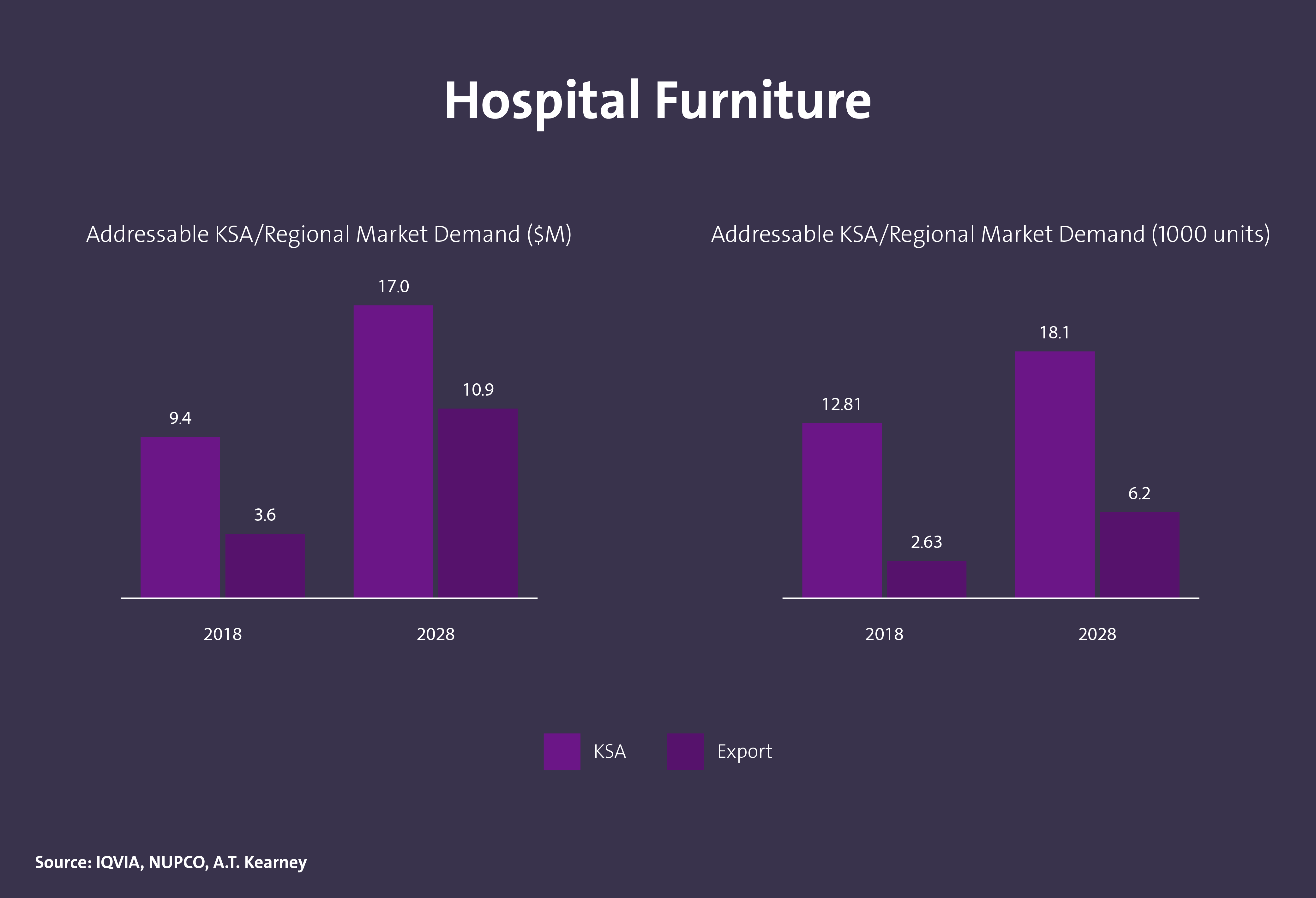

KSA MEDICAL FURNITURE MARKET DEMAND

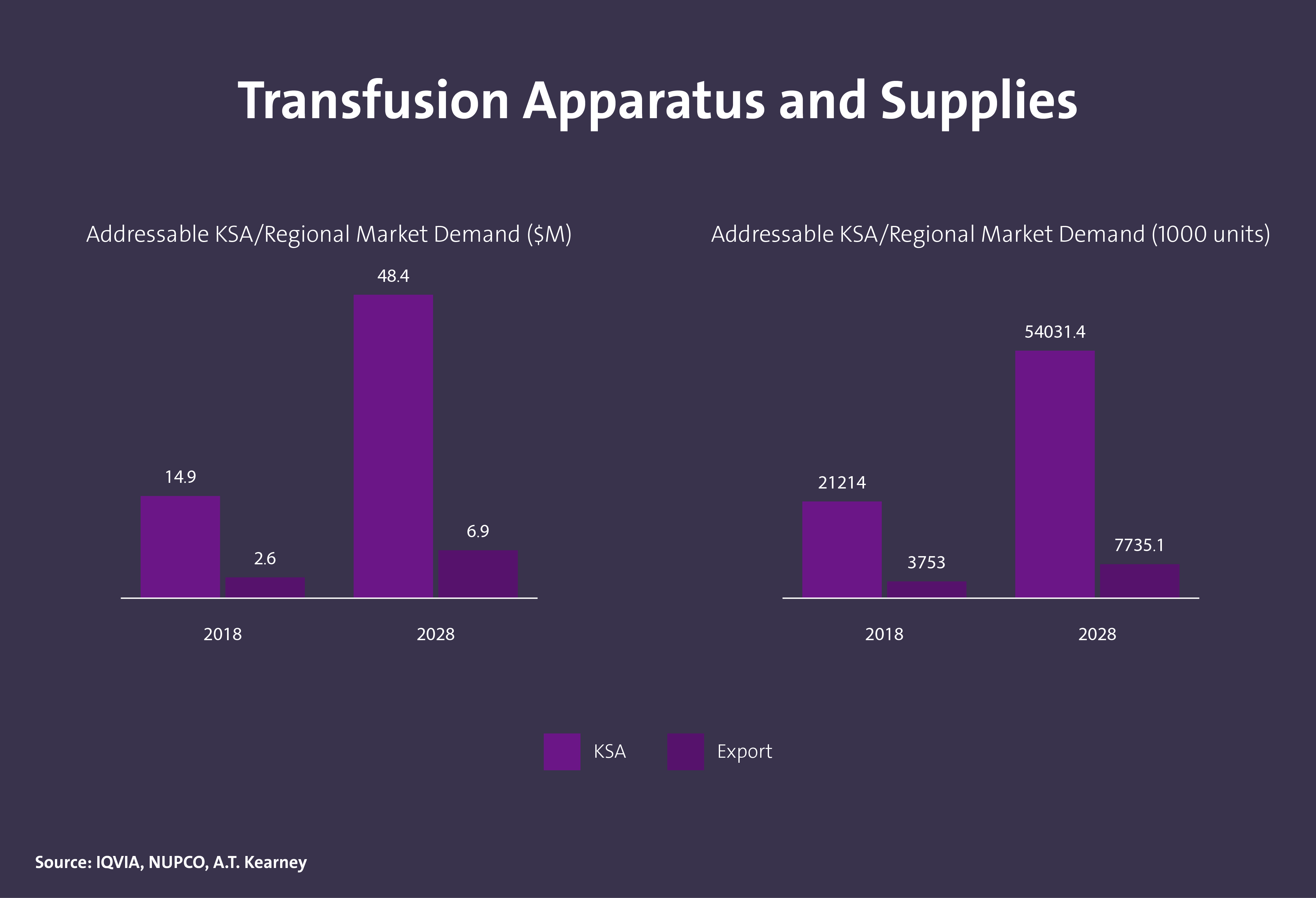

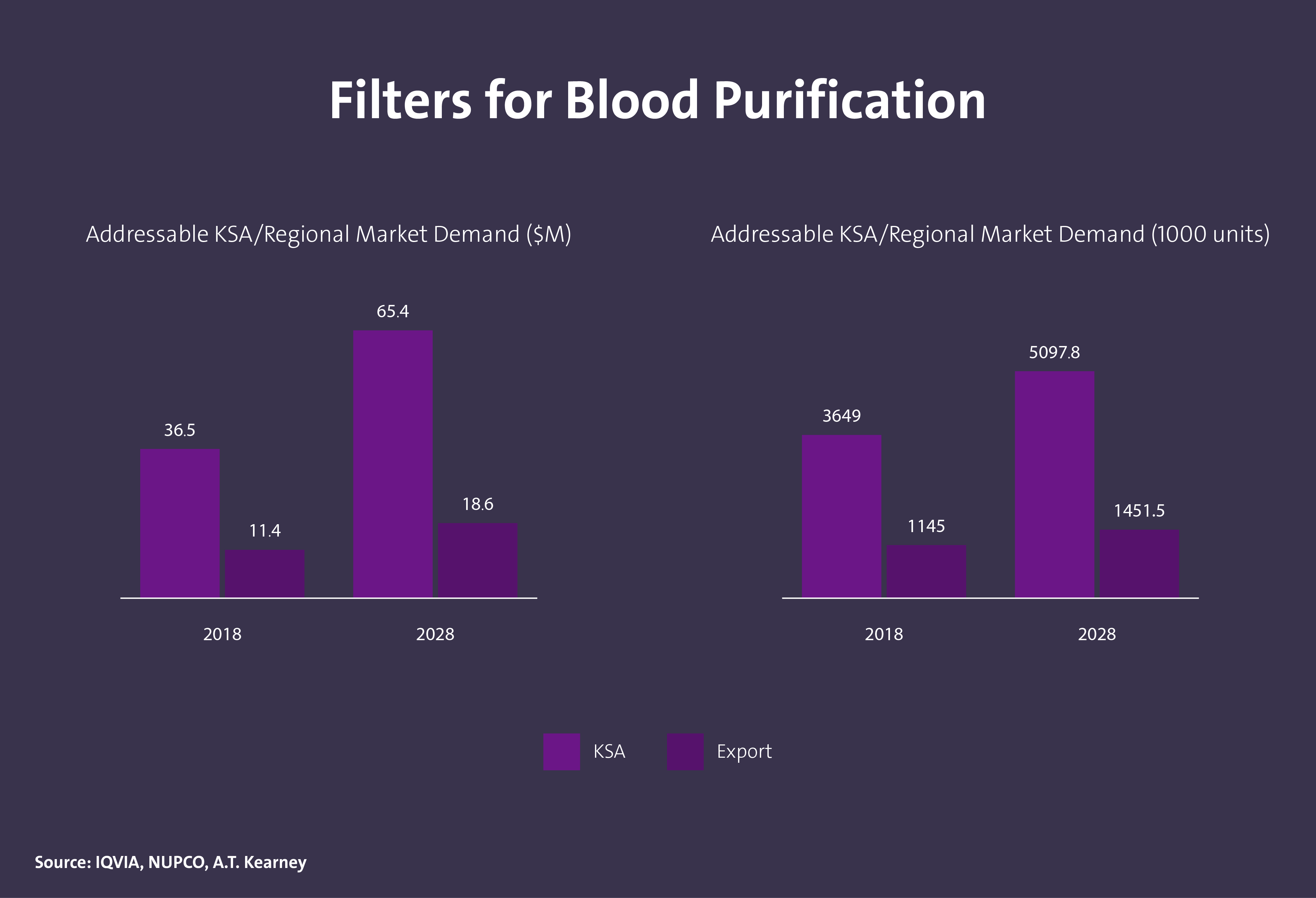

KSA TRANSFUSION APPARATUS AND SUPPLIES MARKET DEMAND

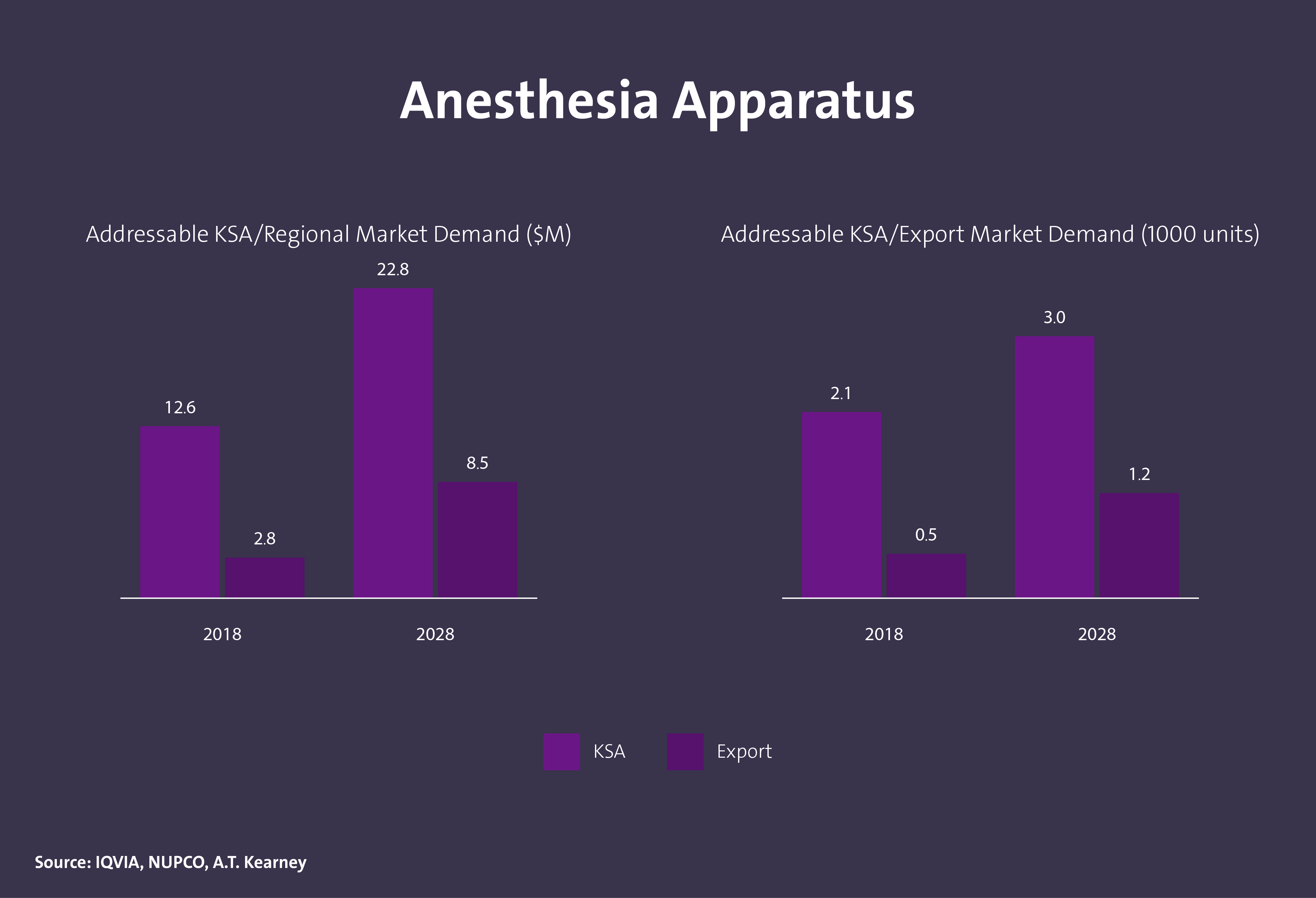

KSA ANESTHESIA APPARATUS MARKET DEMAND

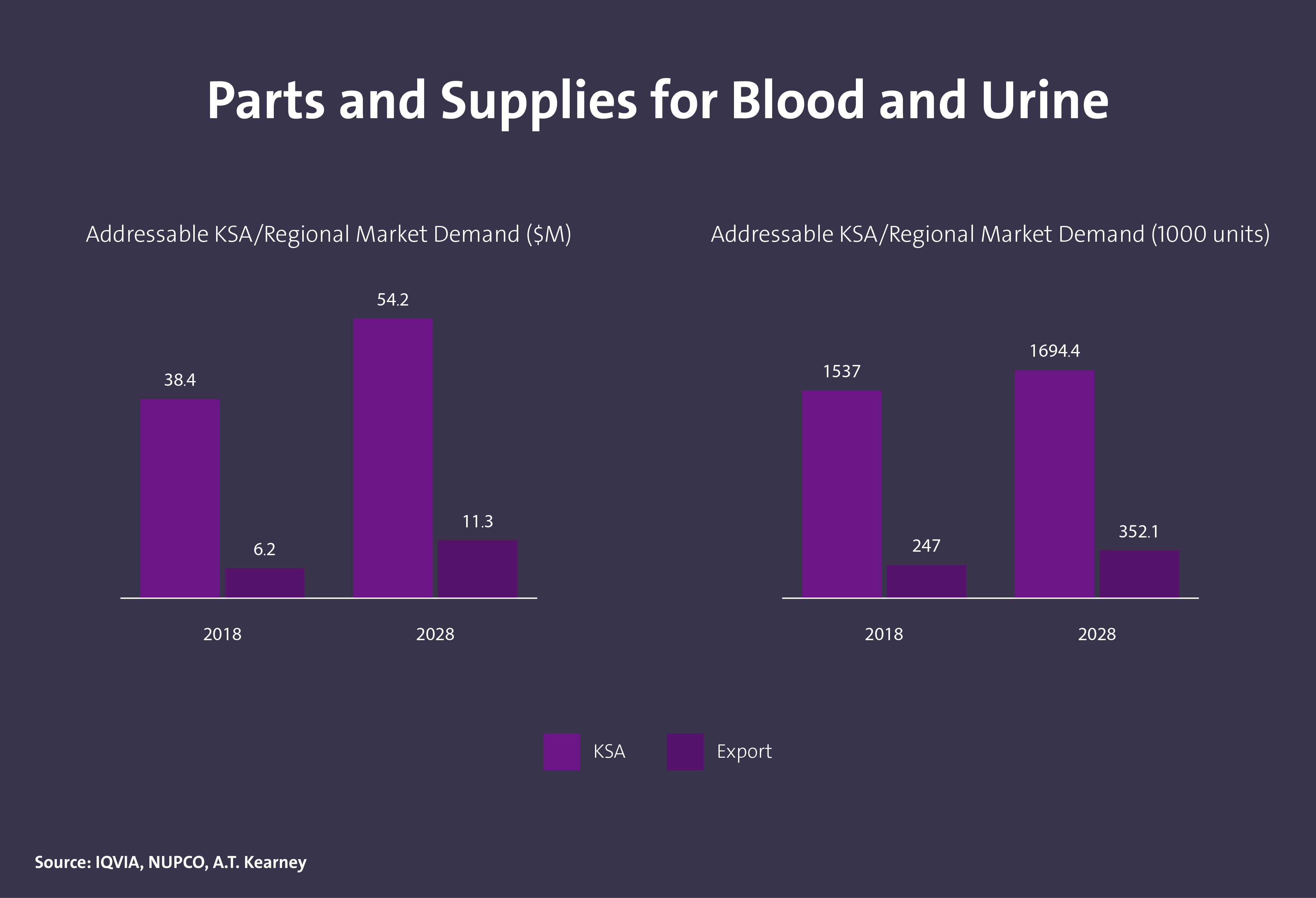

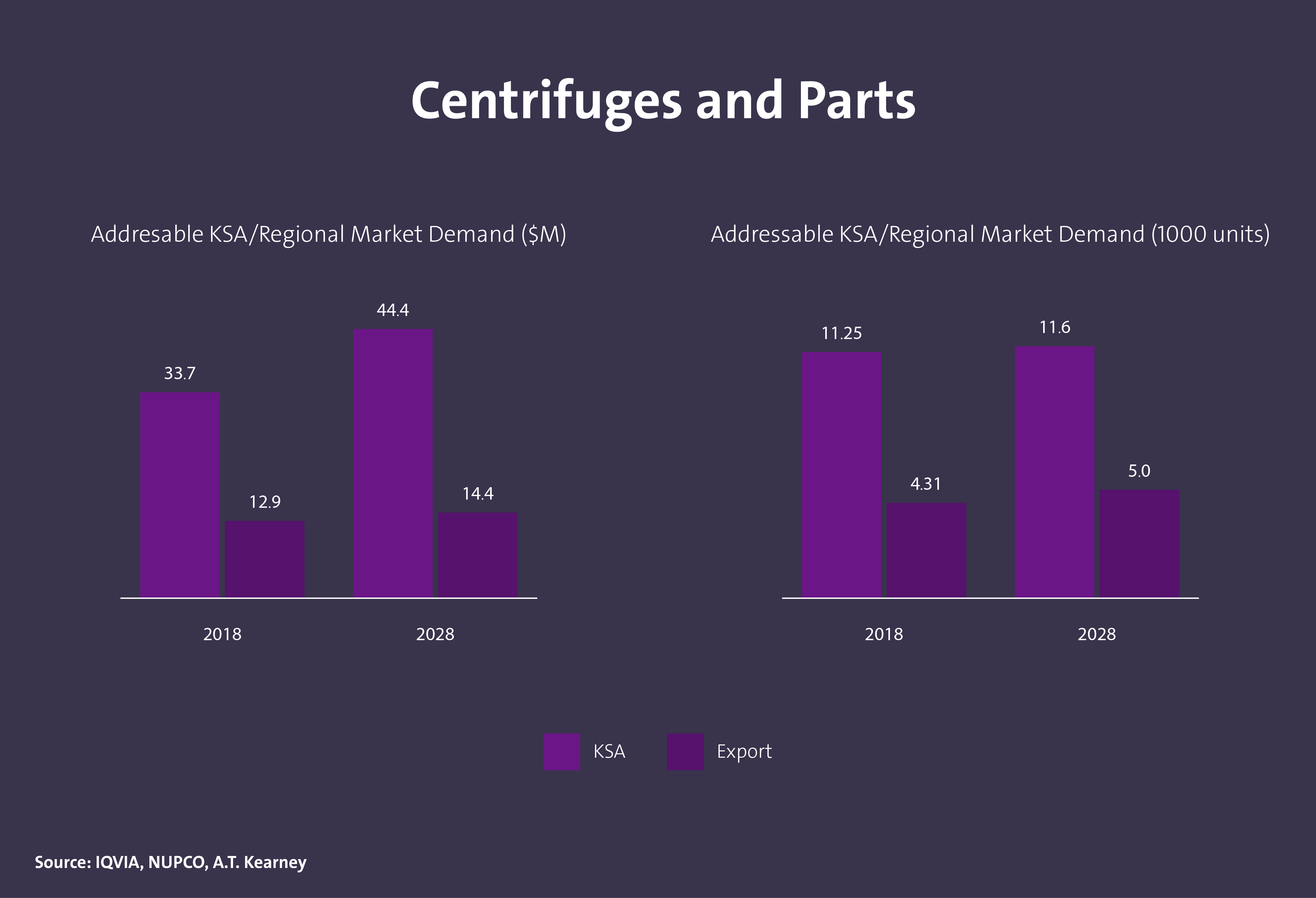

KSA LABORATORY MATERIAL MARKET DEMAND

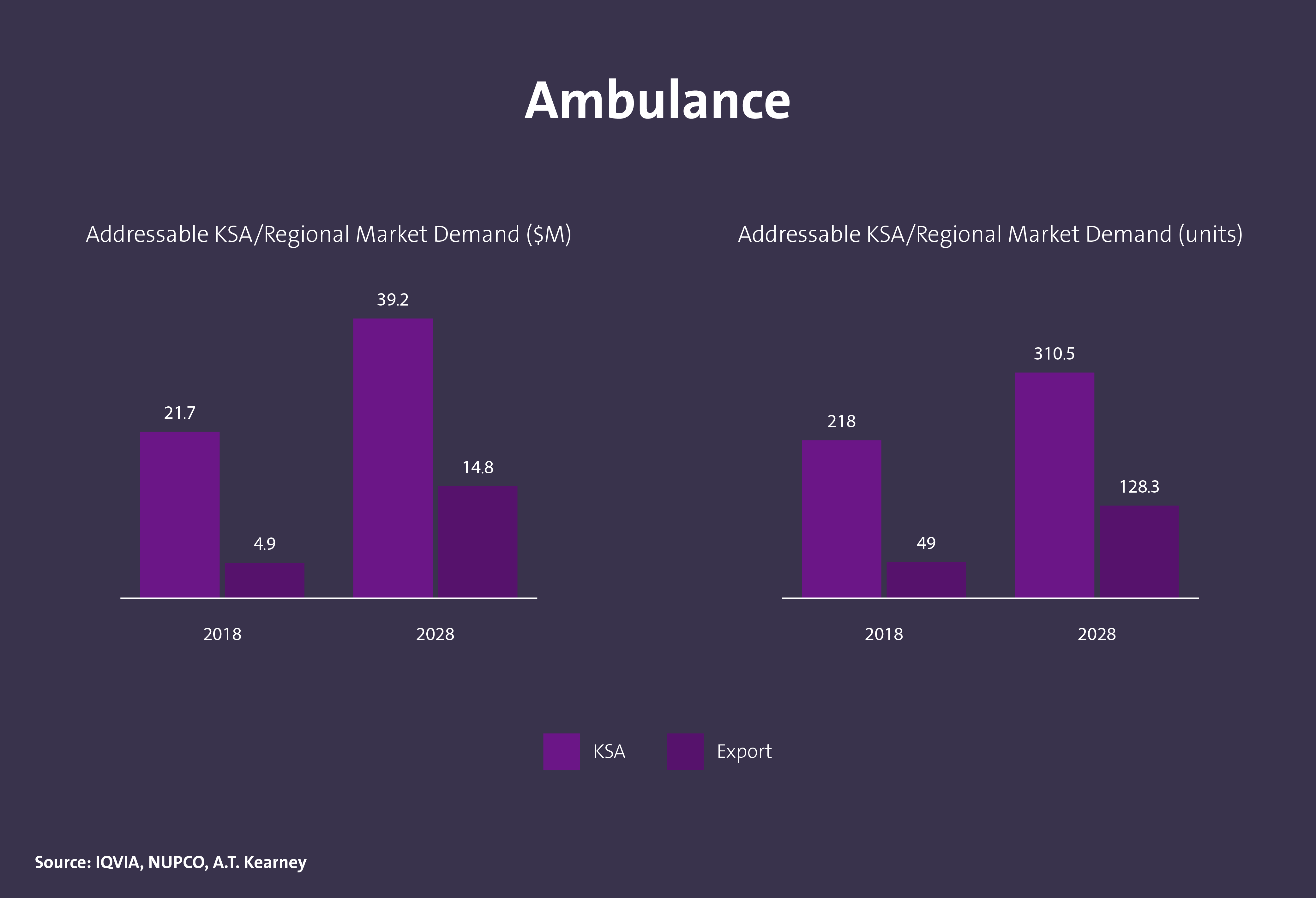

KSA AMBULANCES MARKET DEMAND

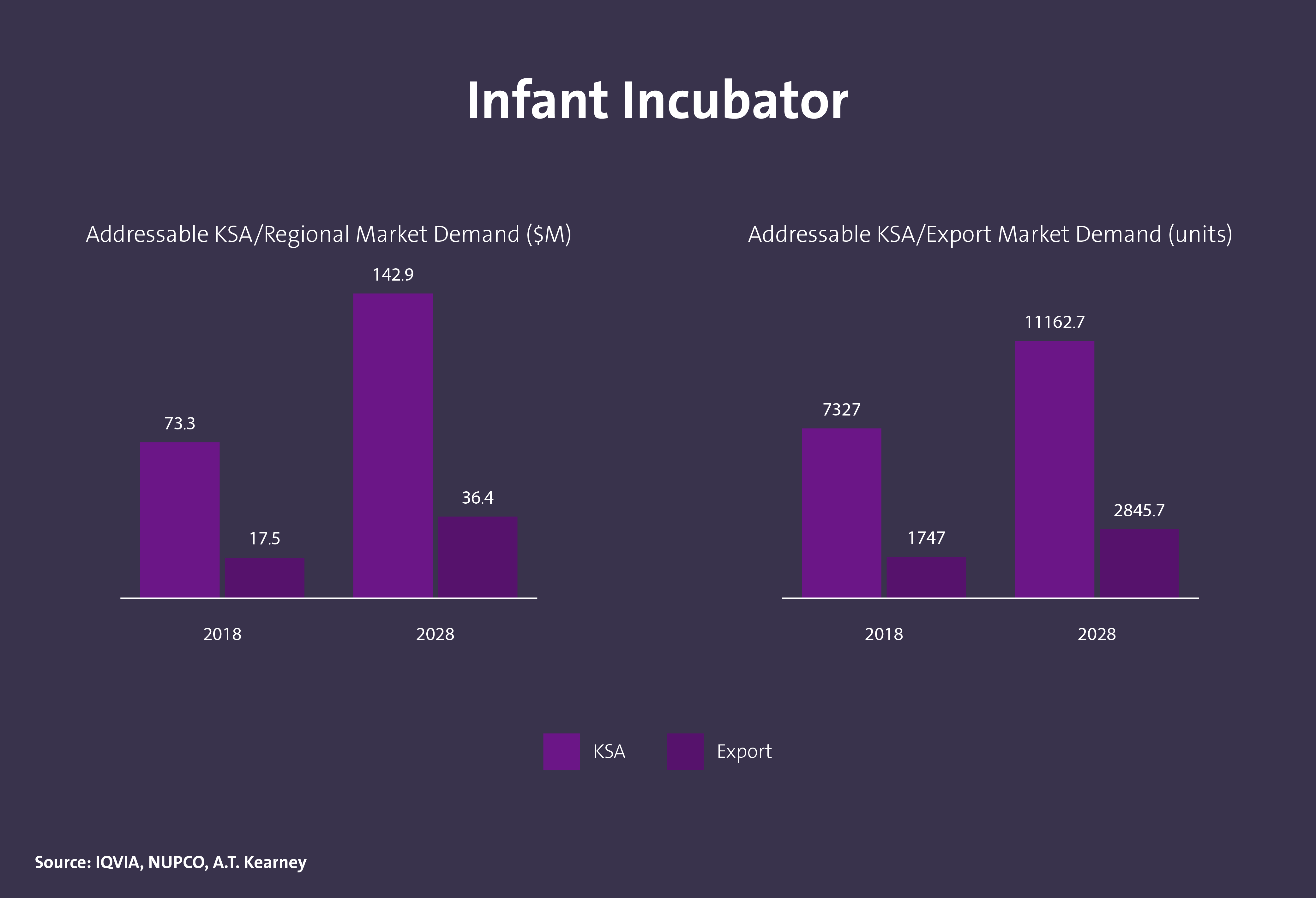

KSA INFANT INCUBATOR MARKET DEMAND

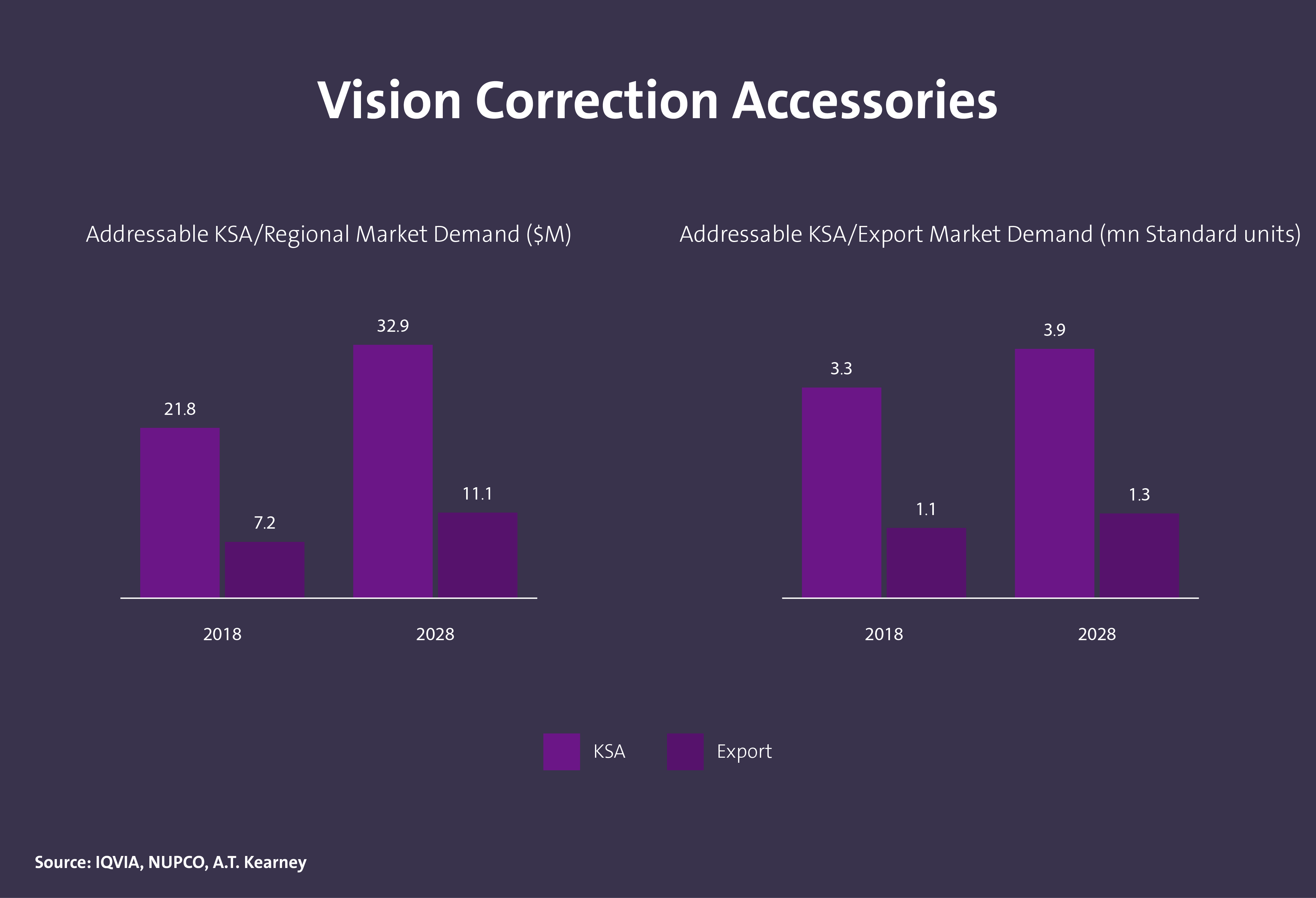

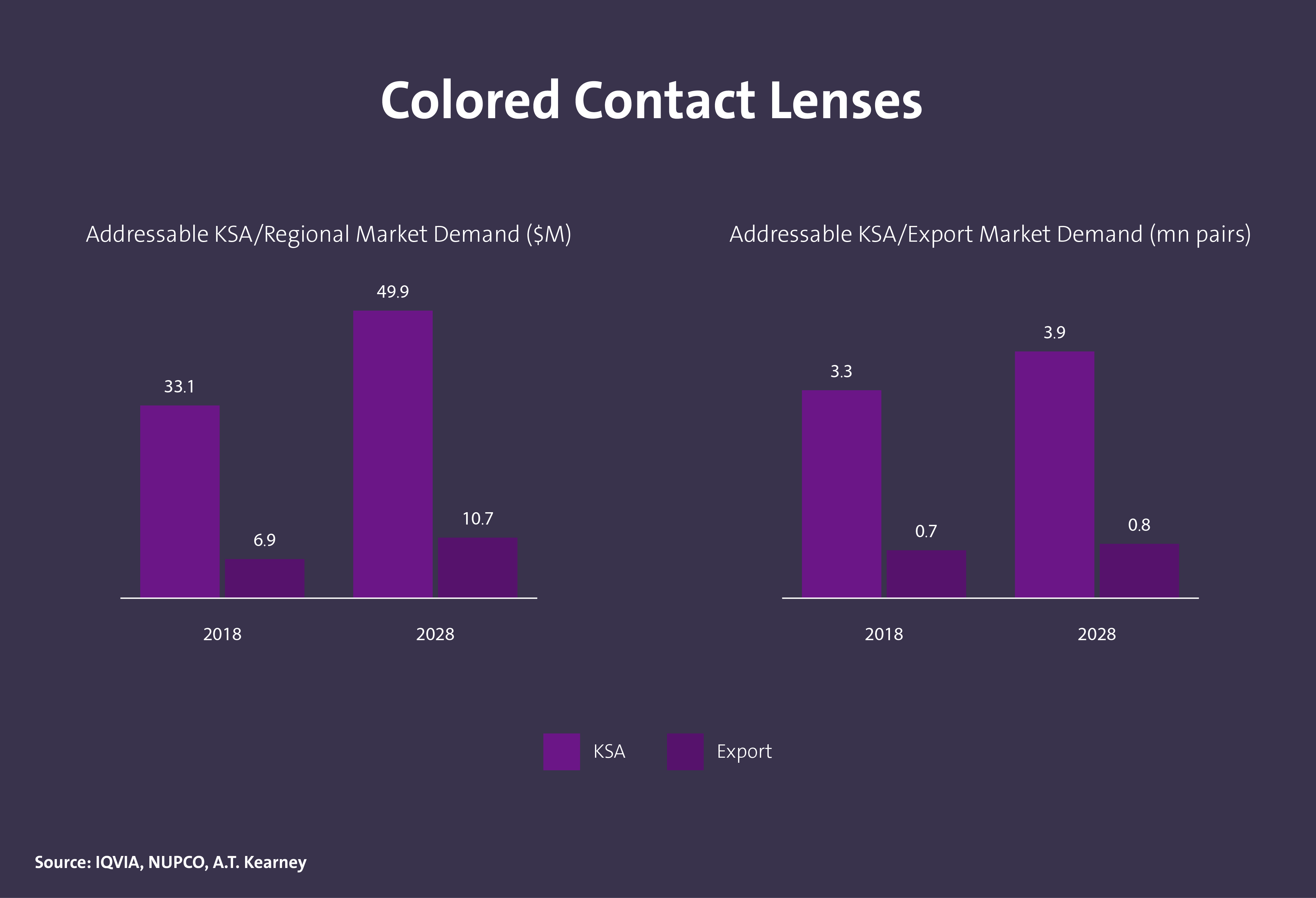

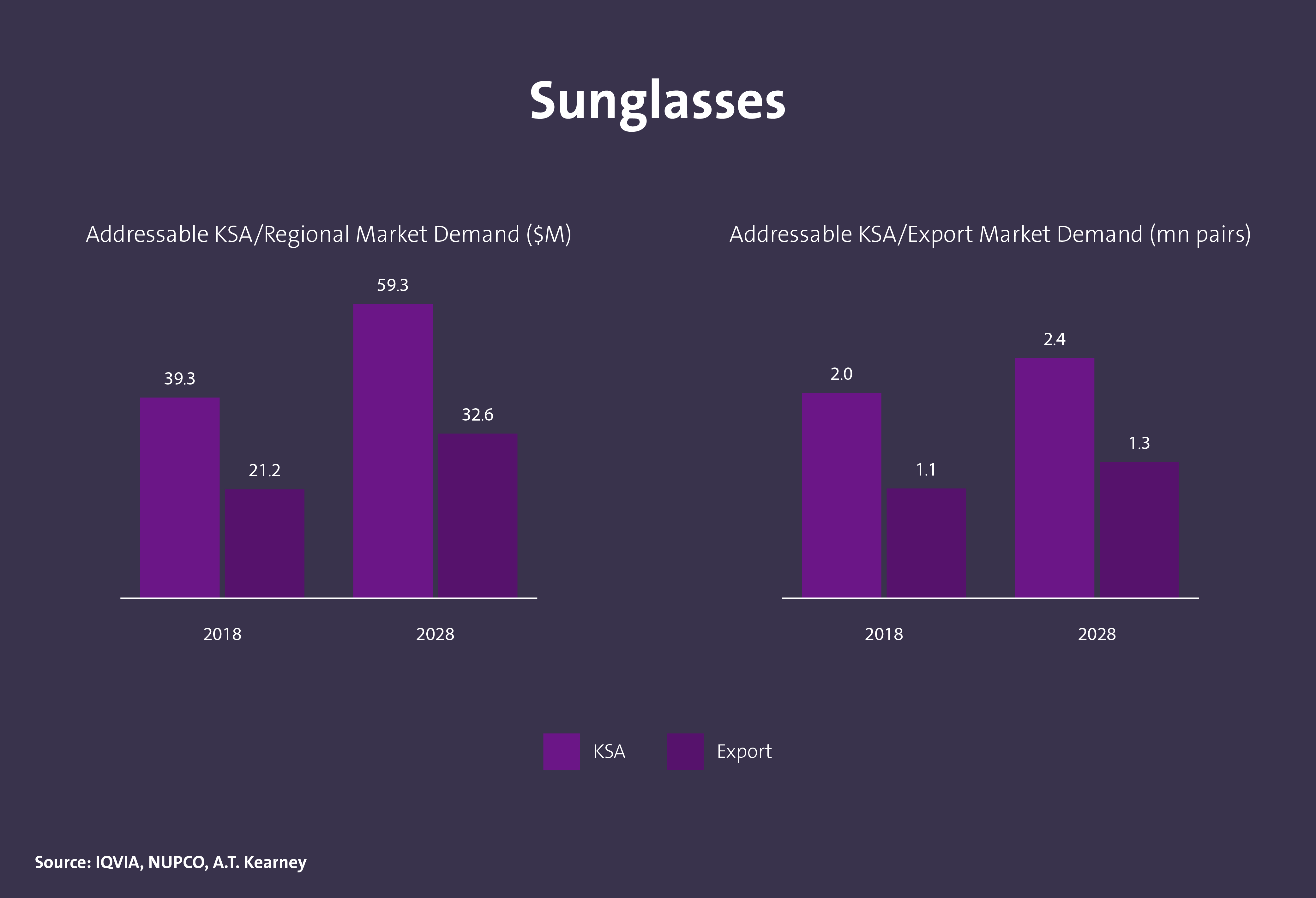

KSA OPHTHALMIC PRODUCTS MARKET DEMAND

The data and information provided through Daleel platform are for indicative purpose, the provided data and information can be assessed further and analyzed as part of the feasibility studies. In addition, following are other key sources of information that can be used for business case development.

Key Sources for Data

National Geological Database

Reliable national geological and topographic data repository for the whole kingdom of Saudi Arabia including geological and topographic maps, Mineral Occurrences Documentation System (MODS), geochemistry and geophysics data, borehole data, surface samples data and more.

Invest Saudi

For information about investment opportunities in the kingdom to both foreign and domestic investors, as well as private sector businesses please visit Invest Saudi

Tariff Rates and Data

Through the website of the Zakat, Tax and Customs Authority, you can find the tariff rates and data for all kinds of products.

Import Data

Through the website of General Authority for Statistics, you can find detailed data on Import Statistics for all kind of goods.

Export Data

Through the website of General Authority for Statistics, you can find detailed data on Export Statistics for all kind of goods.

Factories Directory

The Factories Directory is provided by the National Industrial Information Center to enable the user to inquire about factories in the Kingdom by activity, production and location, in addition to other data and information.

Ministry of Economy And Planning

A unified platform to present and analyze the latest economic and social the kingdom and its regions in visually interactive ways that facilitate understanding of the Saudi economic landscape.

ZADD

ZAADD is one of the services of the Nine Tenths program launched by the Human Resources Development Fund with the aim of developing small and medium-sized enterprises and making them job-producing institutions. The program also enjoys support from many data-providing entities.